A word from Hugo Lasat, CEO &

Gilles Samyn, Chairman of the board of directors

Dear shareholders,

2023 started on a challenging note with an anticipated economic slowdown globally. Yet, fears of a recession did not materialize as the global economy proved more resilient than initially expected. Consequently, tighter monetary policies led to a genuine rate reset and reshaped the financial landscape.

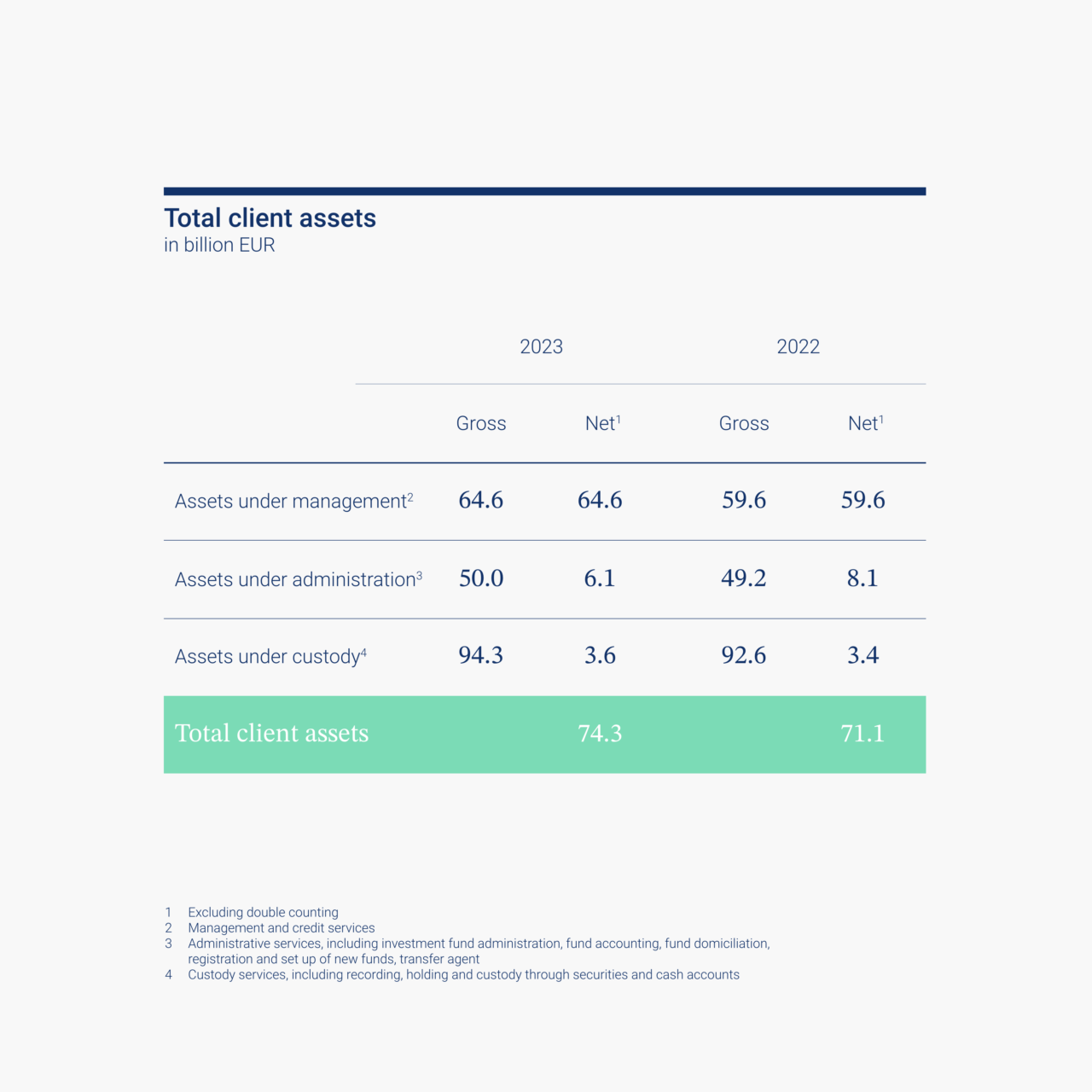

The rise in interest rates has contributed to our business lines’ solid income evolution and positively influenced our overall net margin. In this context, Degroof Petercam ended the year with client assets reaching 74.3 billion euros (excluding double counting), which represented a 5% increase compared to 2022, also driven by positive market performances.

Our integrated model strengthens group’s resilience

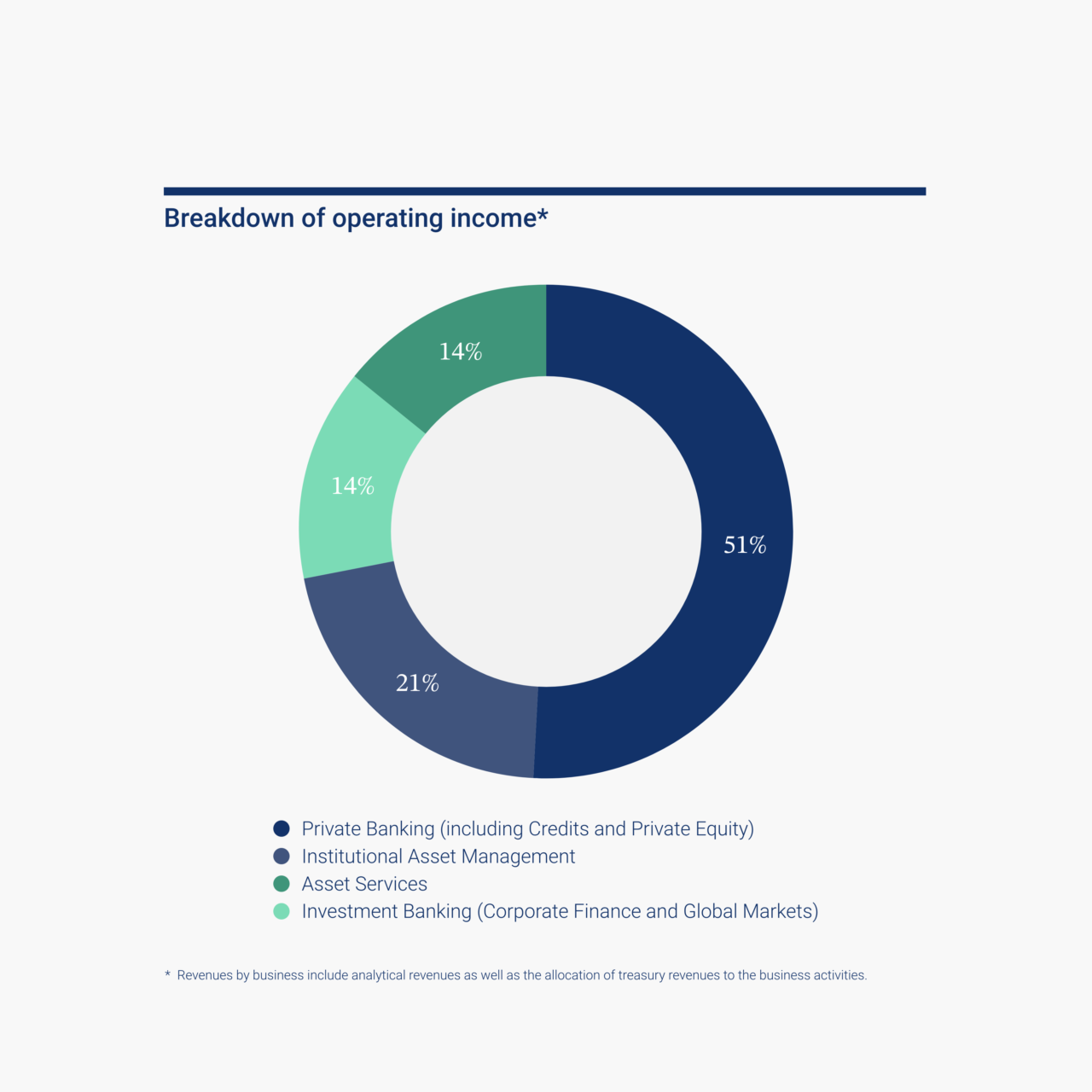

Our net banking income totaled 579 million euros in 2023, up 4% compared to 559 million euros a year earlier. While the positive interest rate environment has brought additional revenues, these were partially mitigated by lower net commissions.

Operating costs were impacted by increasing personnel costs resulting from a growing headcount and by an inflation effect. The Gross Operating Result reached 118.5 million euros, an 11% increase compared to 2022. Meanwhile, net profit decreased from 76.4 million euros in 2022 to 56.3 million euros in 2023. This is explained by non-recurring items weighing on our net results among others the costs associated to the strategic review of the group's shareholder structure and an increase in corporate taxes.

Private Banking

In 2023, Private banking clients have confirmed their trust in us. Their high satisfaction rate reflects the quality of the relationship that binds us, our staff’s expertise and our valuable personalized approach. Loan volumes have understandably declined as a consequence of rising interest rates. Our private equity business experienced an all-time high, topped by our Vintage Private Equity fund which was a commercial success in Belgium and in Luxembourg. Numerous clients saw it as an opportunity to subscribe for the first time to a private equity investment. These promising initiatives, coupled with the adoption of a new core banking, Portfolio Management System and CRM system, will help us achieve our aim to generate positive net inflows next year.

Asset Management

Total net new money reflects our expanding and loyal client base. This is undoubtedly the result of DPAM’s investments in people and in its data, operational and digital platform. At year end DPAM has collected 1.1 billion euros in net new cash. Fixed Income strategies performed solidly, Multi-Asset and Global Equity strategies kept a steady course, against mixed performance for core European Equity solutions, without questioning long-term performance. Another highlight was DPAM’s first place in the Responsible Investor Benchmarking Index 2024 ranking out of 600 responsible asset managers globally (Hirschel & Kramer (H&K)).

Asset Services

Our assets under administration experienced net outflows due to the exit of one client who transferred the administration of its funds to its new parent company. This outflow was partially compensated by the successful onboarding of our largest third-party client ever. Together with three additional onboardings ongoing, this resulted in a total of almost 1 billion euros assets of new third-party funds registered in 2023.

Investment Banking

After a strong 2022, our global markets activities have experienced a solid year. In the sell-side activities, revenues related to Equities increased following high market volatility throughout 2023 and our stock option plan sales performed well with an increasing number of clients over 2023. Our buy-side execution desk revenues remained comparable to last year.

As for corporate finance activities, 2023 was more challenging: the rising interest rates environment increased the cost of financing deals, resulting in some delays and fewer transactions. However, our teams managed a great performance by securing several prominent deals.

See all of our 2023 highlights.

Financial strength and excellent capitalization

Our balance sheet remained robust with solvency and liquidity ratios remaining above the minimum prudential requirements. On December 31, 2023, our consolidated solvency rate stood at 24%. Our balance sheet amounts to 8.1 billion euros, consisting of more than 4.5 billion highly liquid assets. On top of that, our excellent level of capitalization, which results from prudent management of our group financial resources and activities, provides us with the means to invest further in our business development and boost our client value proposition.

Route 26 roadmap

In 2023, we progressed on our “Route 26 roadmap”, our three-year strategic plan that sets the following targets:

- boost business

- be an employer of choice

- make a mark on society

Boosting our business goes beyond the usual financial metrics. Our client-centric approach is consistently reflected in the remarkable satisfaction rates obtained across our different business lines. The trust and knowledge of our professionals form the cornerstones of the relationship with our clients.

As an employer of choice, we remain committed to fostering talent development. We accompany our staff with the right support and create a positive working environment as illustrated by our ambitious learning modules and leadership programs.

As for making a mark on Society, our commitment extends beyond the realm of finance. We aim to promote responsible prosperity for all and we take it seriously. We have progressed both at corporate and business level. We extended DPAM’s Net Zero Commitment taken to the entire group and included ESG-related scorecards and KPIs in the variable remuneration of our staff. As an early adopter of the biodiversity engagement, DPAM is committed to align with the Taskforce of Nature Related Financial Disclosures. Supported by strong governance and the deep involvement of our teams, we focus on all aspects of our business and support services to create sustainable impact.

Outlook

We remain best positioned to address our clients’ needs and expectations and create value for our stakeholders. As demonstrated in positioning campaigns, we claim proudly our unique identity as a reference investment house driven by people, who are our strongest asset in fast moving and commoditized markets. We would like to pay tribute to our talented teams, whose efforts have contributed to our leadership in our respective activities and services.

2023 was marked by the context of reference shareholders changes. The signing of the agreement with Indosuez Wealth Management on August 3, 2023, brought clarity on how the new ownership will reinforce our ability to further engage with staff and clients as a future pan-European leader in private banking and asset management, and invest in corporate finance global markets and asset services.

In this context, we take the opportunity to thank all our shareholders for their long-time commitment and support, and more importantly, we would like to express our gratitude to clients, for their undisputed trust.

The proposed alliance with Indosuez Wealth Management, a subsidiary of Crédit Agricole, will provide us with a new controlling shareholder, backed by a leading global player, subject to regulatory approval.

This solid strategic partner, who knows our activities inside out, will further strengthen the Degroof Petercam franchise, while nurturing our agility and entrepreneurial spirit in the interest of our clients. This transaction will be carried out in partnership with the CLdN group, a historical shareholder which will retain a stake around 20%, reflecting the desire to preserve our roots and domestic presence in Belgium for the long term.