Sylvie Huret, CEO Degroof Petercam

Gilles Samyn, Chairman of the board of directors

Dear shareholders,

The geopolitical and economic challenges of 2023 persisted into 2024, although inflation and energy prices have stabilized. The European Central Bank's measures, coupled with a tight monetary policy, have contributed to maintaining stability within the eurozone while preserving favorable market conditions. Despite a slight decline in interest rates, rising markets positively impacted Degroof Petercam's results.

Business driven growth

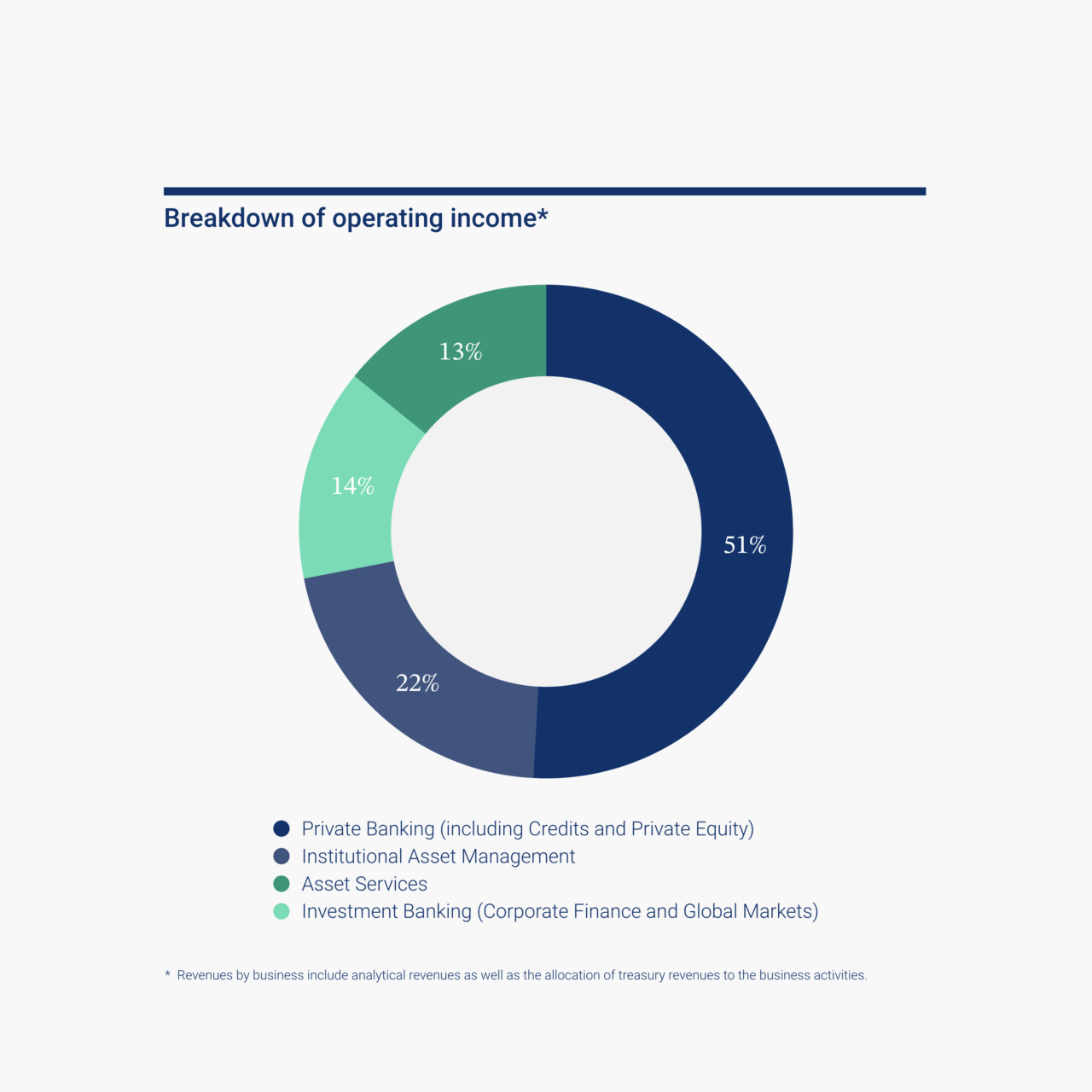

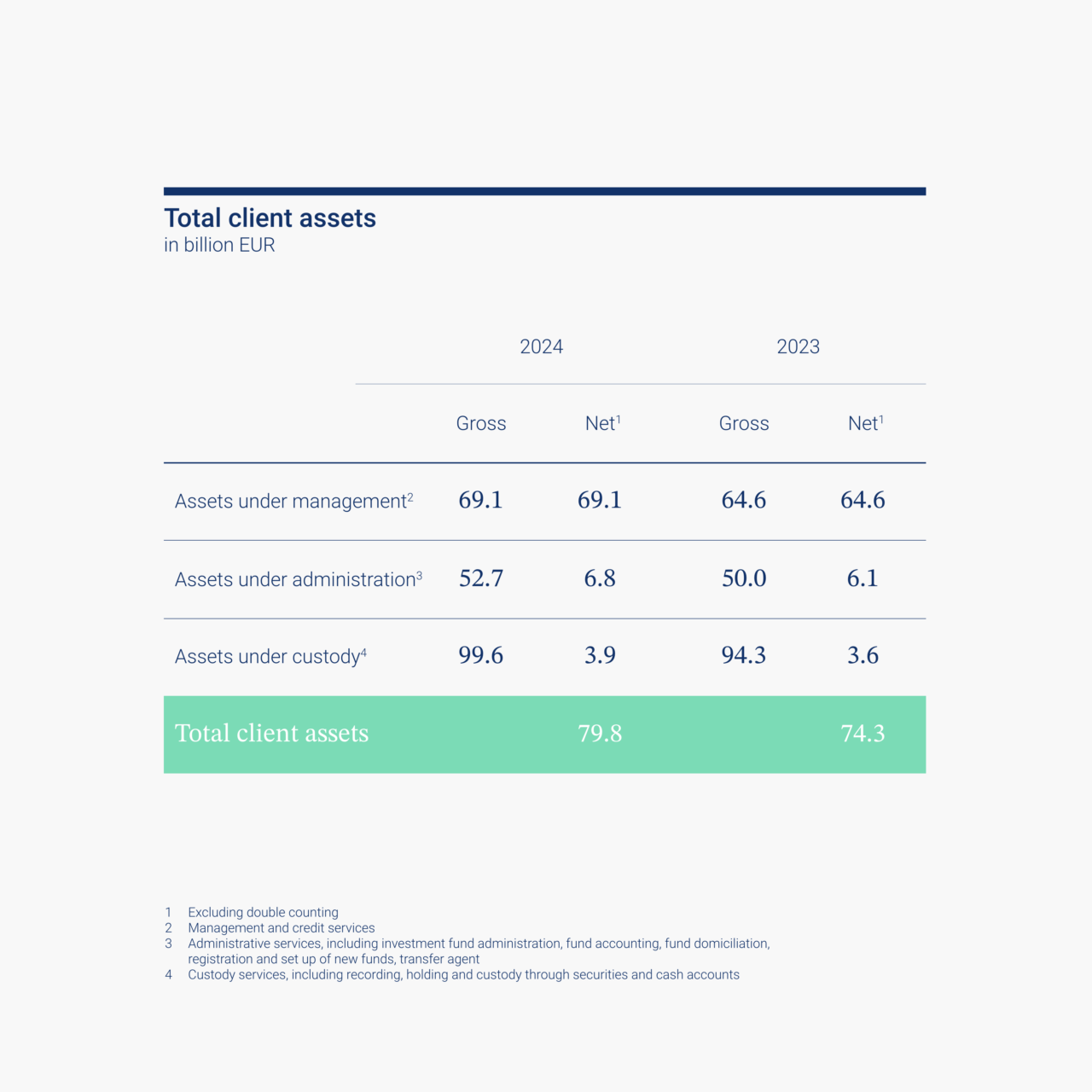

Private Banking was a key contributor to Degroof Petercam's results. Assets under management increased to 38.2 billion euros, driven by a proactive sales development strategy and favorable market conditions. The momentum was further supported by growth in the credit portfolio, despite falling interest rates. Private equity revenues also recorded an uptick, particularly by the launch of new funds and collaborations with leading external managers.

Institutional Asset Management closed the year with 50.3 billion euros under management, reflecting significant commercial expansion, bolstered by the launch of five new funds. In terms of performance, the majority of bond strategies posted net outperformance, third-party multi-asset strategies and institutional mandates outperformed the competition in most cases, and the global equities franchise confirmed its strong five-year positioning. DPAM's first-place ranking in the Hirschel and Kramer (H&K) Responsible Investment Brand Index (RIBI) 2024, among 600 sustainable asset managers worldwide, underscores our commitment to responsible investment.

Asset Services continues to drive growth, with 52.6 billion euros under administration. Fund administration services experienced an increase in capital, particularly due to the onboarding of new third-party funds. Preparations for the implementation of the future client service model, which leverages the strengths of the new entities within the enlarged Group, underscore the appeal of our ‘one-stop-shop’ model for both internal and external clients.

Investment Banking concluded the year with a 5% increase in current gross profit compared to 2023, driven by higher buy-side and foreign exchange volumes, partially offset by lower sell-side income from derivatives and equities. In corporate finance, 2024 saw a decline in M&A activity due to a less buoyant market environment. However, this decline was partially mitigated by robust capital markets activity.

See all of our 2024 highlights.

Consult the breakdown of our operating income.

Digital advances

In 2024, we continued to enhance our digital capabilities, launching a new platform with advanced transactional functionalities that allow for the complete digital integration of new clients. Additionally, we initiated a program to transform our operational and support applications. These key initiatives aim to leverage the full potential of the cloud, artificial intelligence, and advanced collaboration tools to improve reporting, data analysis, and benchmarking processes.

Net income up 39%

By the end of fiscal 2024, consolidated net profit had reached 78.3 million euros, marking a 39% increase from the previous year's 56.3 million euros. This growth reflects reduced overheads and higher net commission income, partially offset by a slight interest margin decline.

Following the integration of Bank Degroof Petercam with Indosuez Wealth Management, we began simplifying our legal structures. This led to the decision to sell the French entities of the Degroof Petercam group to Indosuez Wealth Management in December 2024, with the Luxembourg entities scheduled for sale in 2025.

Excluding the activities to be divested, total client assets would have reached 66.2 billion euros, and consolidated net income would have stood at 67.5 million euros by the end of fiscal 2024, an increase of 25 million euros compared to the previous year's 42.5 million euros.

Financial strength

Consolidated shareholders' equity, including third-party interests, stood at 1,081.4 million euros at year-end, an increase of 83.8 million euros compared to last year. As of December 31, 2024, the consolidated solvency ratio was 29.5%, well above prudential requirements.

Outlook and strategy

In the face of geopolitical uncertainty and an ever-changing economic landscape, we remain more committed than ever to fulfilling our role as a trusted expert for our clients. The integration of Bank Degroof Petercam and Indosuez Wealth Management, initiated in 2024, further strengthens our position and enables us to offer an extended continuum of personalized services. We would like to take this opportunity to express our sincere gratitude to our clients for their loyalty and trust, which continue to inspire us to exceed expectations and stay true to our mission.

Degroof Petercam fully aligns with Indosuez's new medium-term strategic plan, which will cover the period from 2026 to 2028 and will be announced at the end of 2025.

A new chapter in our history

For over 150 years, our founders and successive generations of shareholders, managers, and staff members have contributed to the evolution and growth of our expertise. We would like to once again express our deep gratitude to our former family shareholders for their support over the past decades, and to Hugo Lasat for his decisive role in the development of Degroof Petercam as CEO over the past three years.

We are now entering a new phase in our history. Building on past achievements, we are ready to lead Degroof Petercam into a promising new era of growth within our new group, Indosuez Wealth Management.

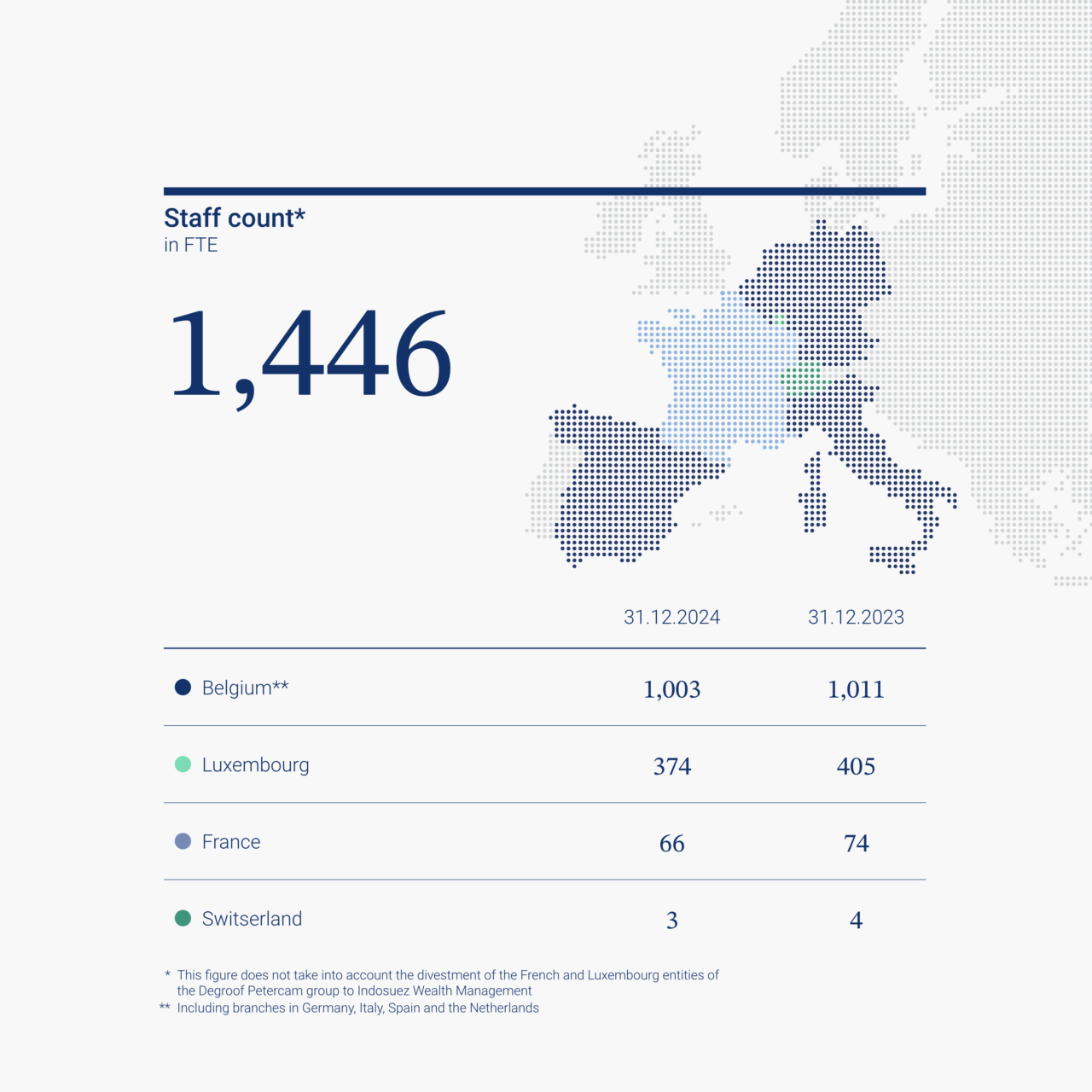

We extend our sincere thanks to our staff members, whose expertise and dedication are the foundation of our success. Their commitment empowers us to face challenges with confidence and seize opportunities boldly. Together, we are building a promising and sustainable future for our company, supported by a long-term committed shareholder who is opening new horizons for us both in terms of expertise and international reach.