Message to the shareholders

"The considerable efforts made by our employees and the remarkable collective intelligence they have developed contributed to another year of progress."

Read the full message to the shareholdersOur purpose

We create responsible prosperity for all, by opening doors to opportunities and accompanying our clients with expertise.

Exactly 150 years ago, in 1871 our story began.

Key figures

Net income

in million EUR

469.22019: 480.6

Gross operating profit

in million EUR

83.02019: 84.4

Consolidated net profit

in million EUR

40.02019: 20.2

Staff count

in FTE

14042019: 1,422

Capital structure at 31.12.2020

DSDC*

Petercam Invest*

Financial partners

Management and staff

Own shares

Total number of shares: 10,842,209

Breakdown of operating income

Private Banking (including Credits and Private Equity)

Asset Management

Asset Services

Investment Banking

*Family and reference shareholders.

DSDC : families Philippson, Haegelsteen, Schockert and Siaens, CLdN Finance and Cobepa.

Petercam Invest: Peterbroeck and Van Campenhout families.

Total client assets

Total client assets

(in billion EUR)

| 2020 | 2019* | |||

|---|---|---|---|---|

| Gross | Net** | Gross | Net** | |

| Assets under management *** | 60.8 | 60.8 | 60.0 | 60.0 |

| Assets under administration **** | 51.7 | 8.4 | 40.5 | 8.5 |

| Assets under custody ***** | 98.4 | 5.8 | 89.3 | 6.2 |

| Total client assets | 75.0 | 74.7 | ||

* The 2019 figures have been restated to reflect the sale of the Spanish subsidiary and to allow comparison with the 2020 figures which exclude the Spanish subsidiary.

** Excluding double counting.

*** Management and credit services.

**** Administrative services, including fund accounting, fund domiciliation,fund directing, registration and set up new funds, transfer agent, etc.

***** Custody services, including recording, holding and custody through securities and cash accounts.

Key figures

Board of directors

Chairman of the board of directors

Ludwig Criel */**

Managing director / Chairman of the executive committee

Bruno Colmant

Directors-members of the executive committee

Nathalie Basyn

Gautier Bataille de Longprey

Gilles Firmin

François Wohrer

Directors

Yvan De Cock*

Miguel del Marmol

Jean-Baptiste Douville de Franssu

Jean-Marie Laurent Josi

Véronique Peterbroeck

Jacques-Martin Philippson

Kathleen (Cassy) Ramsey*

Frank van Bellingen

Guido Vanherpe*

Gaëtan Waucquez***

*Independent Director.

**Ludwig Criel was replaced by Gilles Samyn on 21 January 2021.

***Gaëtan Waucquez was appointed director at the general meeting of 26 May 2020 with an effective date of 13 January 2021.

Key figures

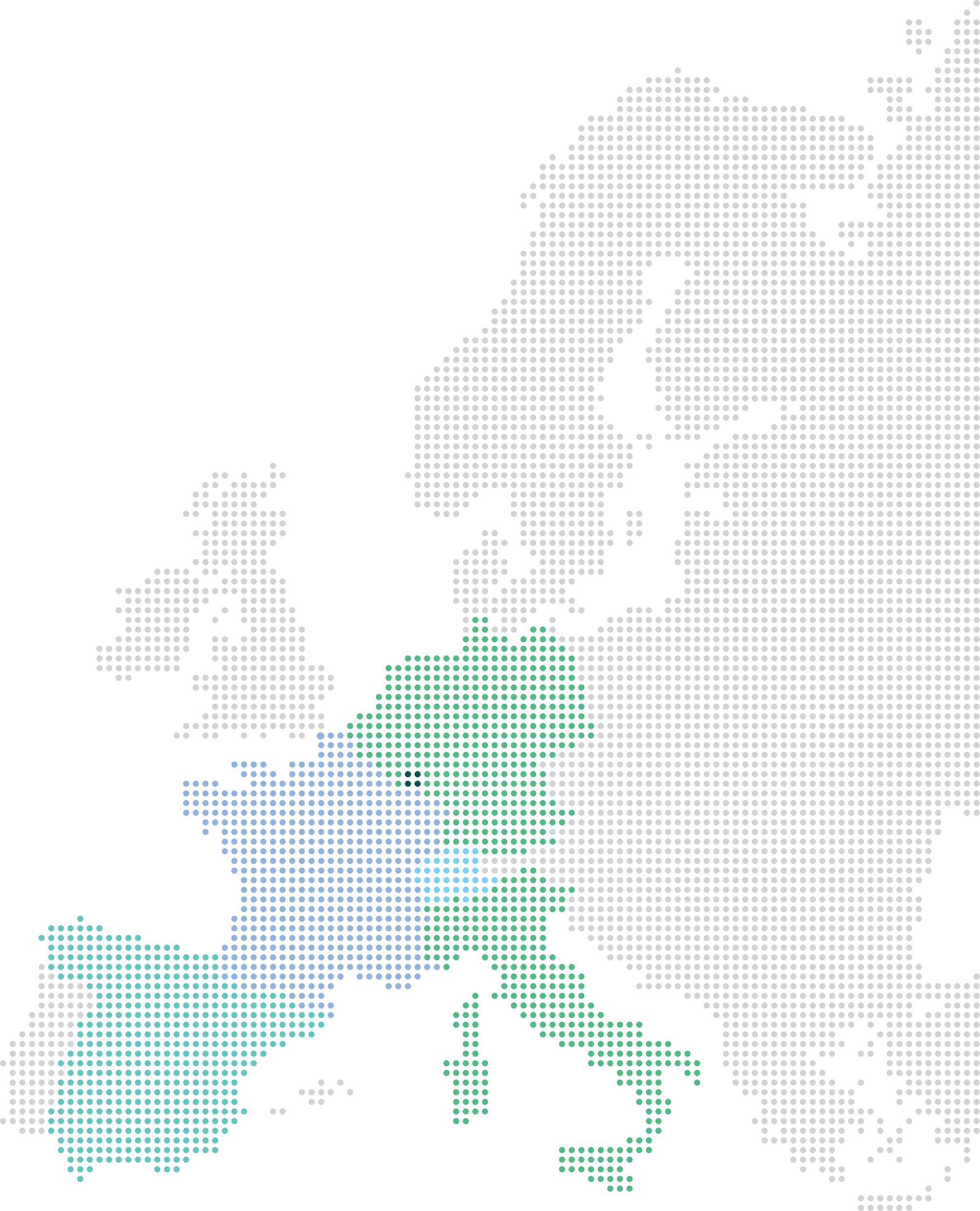

Breakdown by country of staff count

(in FTE)

| 31.12.2020 | 31.12.2019 | |

|---|---|---|

| Belgium* | 911 | 887 |

| Luxembourg | 368 | 357 |

| France | 101 | 100 |

| Spain | - | 57 |

| Switserland | 24 | 21 |

* Including branches in Germany, Italy, the Netherlands and Spain.

What the future will bring, nobody knows. But we strongly believe that our achievements will outlive us.

Highlights

Private banking

35.9 billion euros managed for private clients (gross).

Continued improvement of the client documentation process and of the internal control framework.

Client service at heart with:

The streamlining of the offering to better respond to the needs of our clients;

The opening of new offices in Uccle and Woluwé-St-Pierre to improve client proximity;

The organization of informative, educational and interactive webinar sessions with participation of several thousands of clients and prospects;

The modernization of IT infrastructure.

Solid returns of investment portfolios and 30-year anniversary of patrimonial strategy.

Innovative services contributing to the development:

Private equity projects, including the Inclusio project providing high-quality housing to the vulnerable populations;

Sustainable investments, including new strategy exceeding the one billion euros assets under management milestone;

Family office service dedicated to large families with complex assets;

Dedicated solutions for FBO (Family Business Owners), combining Private Banking and Corporate Finance.

Strong social responsible commitment via the Degroof Petercam Foundation and Gingo community.

Credits

Slight reduction in the net volume of the credit portfolio compared to 2019 to 2.04 billion euros in-line with general economic slowdown.

No loss nor provisions booked on credit portfolio.

Continued strong dynamics in loan activity in Belgium, Luxembourg and France. The commercial focus was carried on Lombard loans granted to customers in Belgium, Luxembourg and France as an alternative to standard mortgage loans.

Average credit margin maintained almost unchanged compared to last year, despite competitive credit environment.

Degroof Petercam Asset Management

Record growth with assets under management (gross) rising 10% to reach 43.3 billion euros with net capital inflow of 2.5 billion euros. Significant inflows in multi-thematic equity and emerging market debt strategies.

Sustainable assets under management (gross) more than doubled, ballooning from 7.2 billion euros to 15.3 billion euros.

Continued international expansion, with 88% of the growth stemming from outside Belgium.

Launch of new sustainable strategies: two focused on multi-thematic equities in Euroland and Asia Pacific, and one focused on convertible bonds worldwide.

Numerous of international awards rewarding quality of the management and investment performances

GRUPPO 24 ORE in Italy: ’Premio Alto Rendimento: Best Foreign Asset’;

QUANTALYS in France: ’Best regional Asset Manager: Equity’;

SCOPE ANALYSIS AG in Germany; Austria: ’Scope Award 2020: Best Asset Manager Fixed Income’.

Asset Services

Record high of 51.7 billion euros of assets under administration and/or in custody (gross) reached.

Migration to the Asset Services fund administration platform of two Belgian mutual funds managed and distributed by Degroof Petercam Asset Management totaling 11.5 billion euros.

Creation of seven new investment funds in listed financial assets for external promoters for a total amount of 235 million euros.

Administration of seven new private equity investment vehicles with total commitments from investors amounting to 357 million euros.

Investment Banking

56 mandates in mergers & acquisitions, capital markets transactions and advisory, for a total of 5.6 billion euros, confirming Degroof Petercam’s leading position in investment banking services for mid-size companies.

39 M&A and advisory mandates of which 16 in Belgium, 21 in France and 2 in Spain, for a total of 2.7 billion euros.

Six equity capital market transactions, mainly in the Healthcare and Real Estate sectors, with the IPOs of Nyxoah, Unifiedpost and Inclusio on Euronext Brussels and the capital increases of Aedifica, Acacia Pharma and OSE Immunotherapeutics.

11 debt capital market transactions including the private placements for Elia, Cofinimmo, Retail Estates and FFP (family holding of the Peugeot family), confirming number two position in Europe for private placements according to Private Placements Monitor.

A role of board adviser for the take-over bids on Sioen, Zenitel and Orange Belgium.

A record increase of the dealing desk business in all major asset classes worldwide despite lockdown measures and high volatility times.

A nice revenue growth of stock options & incentive plans activities, serving over 50,000 beneficiaries and the confirmation of our market positioning in derivatives services and a strong offering of hedging solutions for private clients and top executives.

The best ever Forex Volume (Spot, Forward & Swap) for a notional amount of more than 100 billion euros in 61 different currencies.

The organization of more than 2,800 investor meetings and Extel recognition with 'Best Corporate Access' Award for successful virtual company roadshows and conferences in Benelux region.

The expansion of sell-side research to French and German companies in Healthcare and Real Estate sectors.

The distribution of more than 50 detailed research reports and the publication of the annual Company Handbook.

Responsible Investment

20 years anniversary since the launch of the first sustainable investment strategy.

More than doubling of gross assets into DPAM SRI funds with more than 15 billion euros invested in sustainable strategies, across various asset classes.

Focus on climate:

Member of the collective engagement initiatives 'Responsible outsourcing of cobalt', 'FAIRR';

’Investor Alliance for Human Rights’ and the ‘Finance for Biodiversity Pledge’;

Signatory of the Investor Charter 'Investor statement on deforestation and forest fires in the Amazon' via the UN backed Principles of Responsible Investment (PRI);

Implementation of the recommendations from the Taskforce on Climate-related Financial Disclosures (TCFD).

Active shareholder responsibility through:

Voting Advisory Board which participated in 688 general meetings of shareholders and voted on 9,571 resolutions;

Sending of 101 commitment letters to companies to incentive them for better corporate governance.

Further international recognition:

ETICA NEWS in Italy: ’SRI Awards 2020: Best SRI Asset Manager’;

CITYWIRE / H&K RESPONSIBLE INVESTMENT BRAND INDEX 2020 in Europe ’Top 10 Asset Managers truly committed to ESG’ 4th place – Avant-gardist;

UNITED NATIONS - PRI: A+ rating for the 4th year in a row;

ALFI European Distribution Award in the category of the Fastest Riser in ESG.

Labeling of the two patrimonial strategies from Private Banking according to the Towards Sustainability criteria, defined by the Belgian financial sector.

Private Equity

Despite challenging environment, robust performance and pace of deployment of existing private equity investments and dynamic fundraising momentum mainly driven by established players.

Overall strong resilience of our selected private equity funds, across all strategies.

Solid fundraising activity across all countries of the group with 175 million euros of new commitments raised for the newly placed private equity funds, in core strategies (buy-out, co-invest, secondaries) and including a mix of re-upping in successor funds and new partnerships.

Completion of major transaction with the exit of Green Funds II and III, focused on the renewable energy sector (onshore wind farm projects in France) resulting in internal rate of return (IRR) in excess of 20%.

Significant distributions from various other private equity funds.

Philanthropy

Conference-debate on the theme of 'engaged shareholdership', mobilizing 120 young people and leading to an awareness among the new generation of their role as responsible shareholders and investors.

Organization of a meeting with 60 Belgian philanthropists in the presence of the Armenian philanthropist Veronika Vardanyan, a world figure in the field of daring philanthropy.

One million euros awarded by the Degroof Petercam Foundation to 'Bayes Impact', an NGO that uses technology for social purposes. This amount is also complemented by a five-year support to enable 'Bayes Impact' to develop its 'Bob Emploi' programme, a platform that uses artificial intelligence to guide people in their search for a job.

Sustained mobilization of employees around social projects:

225 colleagues who took part in a sports challenge that raised 13,000 euros for six associations;

36 employees mobilized around the skills sponsorship program aimed at advising social initiatives or sponsoring job seekers in France and Belgium;

Almost 30,000 euros collected through micro-donations by colleagues to 'MakeSense';

Cycling trip sponsored by the Degroof Petercam cycling team to benefit the Cancer Foundation.

The milestone of one million donations collected over five years through Gingo, the crowdfunding platform dedicated to the financing of social projects in Belgium and Luxembourg, was exceeded.

Additional commitments during the Covid-19 crisis:

Donation of 150,000 euros to ’Médecins du Monde’ to support primary care efforts with the most excluded patients;

50,000 euros donated to the 'Fund for solidary care' initiated by the King Baudouin Foundation;

120,000 euros collected by the Gingo platform for the benefit of artists in precarious situations;

Donation of computer equipment to children affected by digital and educational exclusion through the association 'Close the Gap'.

Exceptional financing of three projects by the Degroof Petercam Foundation: 'Revival' which provides support to entrepreneurs facing bankruptcy, 'Microstart' which helps micro-entrepreneurs with loans, as well as a study project on a sustainable and inclusive revival of the economy valuing jobs with a social purpose.

Private banking

35.9 billion euros managed for private clients (gross).

Continued improvement of the client documentation process and of the internal control framework.

Client service at heart with:

The streamlining of the offering to better respond to the needs of our clients;

The opening of new offices in Uccle and Woluwé-St-Pierre to improve client proximity;

The organization of informative, educational and interactive webinar sessions with participation of several thousands of clients and prospects;

The modernization of IT infrastructure.

Solid returns of investment portfolios and 30-year anniversary of patrimonial strategy.

Innovative services contributing to the development:

Private equity projects, including the Inclusio project providing high-quality housing to the vulnerable populations;

Sustainable investments, including new strategy exceeding the one billion euros assets under management milestone;

Family office service dedicated to large families with complex assets;

Dedicated solutions for FBO (Family Business Owners), combining Private Banking and Corporate Finance.

Strong social responsible commitment via the Degroof Petercam Foundation and Gingo community.

Credits

Slight reduction in the net volume of the credit portfolio compared to 2019 to 2.04 billion euros in-line with general economic slowdown.

No loss nor provisions booked on credit portfolio.

Continued strong dynamics in loan activity in Belgium, Luxembourg and France. The commercial focus was carried on Lombard loans granted to customers in Belgium, Luxembourg and France as an alternative to standard mortgage loans.

Average credit margin maintained almost unchanged compared to last year, despite competitive credit environment.

Degroof Petercam Asset Management

Record growth with assets under management (gross) rising 10% to reach 43.3 billion euros with net capital inflow of 2.5 billion euros. Significant inflows in multi-thematic equity and emerging market debt strategies.

Sustainable assets under management (gross) more than doubled, ballooning from 7.2 billion euros to 15.3 billion euros.

Continued international expansion, with 88% of the growth stemming from outside Belgium.

Launch of new sustainable strategies: two focused on multi-thematic equities in Euroland and Asia Pacific, and one focused on convertible bonds worldwide.

Numerous of international awards rewarding quality of the management and investment performances

GRUPPO 24 ORE in Italy: ’Premio Alto Rendimento: Best Foreign Asset’;

QUANTALYS in France: ’Best regional Asset Manager: Equity’;

SCOPE ANALYSIS AG in Germany; Austria: ’Scope Award 2020: Best Asset Manager Fixed Income’.

Asset Services

Record high of 51.7 billion euros of assets under administration and/or in custody (gross) reached.

Migration to the Asset Services fund administration platform of two Belgian mutual funds managed and distributed by Degroof Petercam Asset Management totaling 11.5 billion euros.

Creation of seven new investment funds in listed financial assets for external promoters for a total amount of 235 million euros.

Administration of seven new private equity investment vehicles with total commitments from investors amounting to 357 million euros.

Investment Banking

56 mandates in mergers & acquisitions, capital markets transactions and advisory, for a total of 5.6 billion euros, confirming Degroof Petercam’s leading position in investment banking services for mid-size companies.

39 M&A and advisory mandates of which 16 in Belgium, 21 in France and 2 in Spain, for a total of 2.7 billion euros.

Six equity capital market transactions, mainly in the Healthcare and Real Estate sectors, with the IPOs of Nyxoah, Unifiedpost and Inclusio on Euronext Brussels and the capital increases of Aedifica, Acacia Pharma and OSE Immunotherapeutics.

11 debt capital market transactions including the private placements for Elia, Cofinimmo, Retail Estates and FFP (family holding of the Peugeot family), confirming number two position in Europe for private placements according to Private Placements Monitor.

A role of board adviser for the take-over bids on Sioen, Zenitel and Orange Belgium.

A record increase of the dealing desk business in all major asset classes worldwide despite lockdown measures and high volatility times.

A nice revenue growth of stock options & incentive plans activities, serving over 50,000 beneficiaries and the confirmation of our market positioning in derivatives services and a strong offering of hedging solutions for private clients and top executives.

The best ever Forex Volume (Spot, Forward & Swap) for a notional amount of more than 100 billion euros in 61 different currencies.

The organization of more than 2,800 investor meetings and Extel recognition with 'Best Corporate Access' Award for successful virtual company roadshows and conferences in Benelux region.

The expansion of sell-side research to French and German companies in Healthcare and Real Estate sectors.

The distribution of more than 50 detailed research reports and the publication of the annual Company Handbook.

Responsible Investment

20 years anniversary since the launch of the first sustainable investment strategy.

More than doubling of gross assets into DPAM SRI funds with more than 15 billion euros invested in sustainable strategies, across various asset classes.

Focus on climate:

Member of the collective engagement initiatives 'Responsible outsourcing of cobalt', 'FAIRR';

’Investor Alliance for Human Rights’ and the ‘Finance for Biodiversity Pledge’;

Signatory of the Investor Charter 'Investor statement on deforestation and forest fires in the Amazon' via the UN backed Principles of Responsible Investment (PRI);

Implementation of the recommendations from the Taskforce on Climate-related Financial Disclosures (TCFD).

Active shareholder responsibility through:

Voting Advisory Board which participated in 688 general meetings of shareholders and voted on 9,571 resolutions;

Sending of 101 commitment letters to companies to incentive them for better corporate governance.

Further international recognition:

ETICA NEWS in Italy: ’SRI Awards 2020: Best SRI Asset Manager’;

CITYWIRE / H&K RESPONSIBLE INVESTMENT BRAND INDEX 2020 in Europe ’Top 10 Asset Managers truly committed to ESG’ 4th place – Avant-gardist;

UNITED NATIONS - PRI: A+ rating for the 4th year in a row;

ALFI European Distribution Award in the category of the Fastest Riser in ESG.

Labeling of the two patrimonial strategies from Private Banking according to the Towards Sustainability criteria, defined by the Belgian financial sector.

Private Equity

Despite challenging environment, robust performance and pace of deployment of existing private equity investments and dynamic fundraising momentum mainly driven by established players.

Overall strong resilience of our selected private equity funds, across all strategies.

Solid fundraising activity across all countries of the group with 175 million euros of new commitments raised for the newly placed private equity funds, in core strategies (buy-out, co-invest, secondaries) and including a mix of re-upping in successor funds and new partnerships.

Completion of major transaction with the exit of Green Funds II and III, focused on the renewable energy sector (onshore wind farm projects in France) resulting in internal rate of return (IRR) in excess of 20%.

Significant distributions from various other private equity funds.

Philanthropy

Conference-debate on the theme of 'engaged shareholdership', mobilizing 120 young people and leading to an awareness among the new generation of their role as responsible shareholders and investors.

Organization of a meeting with 60 Belgian philanthropists in the presence of the Armenian philanthropist Veronika Vardanyan, a world figure in the field of daring philanthropy.

One million euros awarded by the Degroof Petercam Foundation to 'Bayes Impact', an NGO that uses technology for social purposes. This amount is also complemented by a five-year support to enable 'Bayes Impact' to develop its 'Bob Emploi' programme, a platform that uses artificial intelligence to guide people in their search for a job.

Sustained mobilization of employees around social projects:

225 colleagues who took part in a sports challenge that raised 13,000 euros for six associations;

36 employees mobilized around the skills sponsorship program aimed at advising social initiatives or sponsoring job seekers in France and Belgium;

Almost 30,000 euros collected through micro-donations by colleagues to 'MakeSense';

Cycling trip sponsored by the Degroof Petercam cycling team to benefit the Cancer Foundation.

The milestone of one million donations collected over five years through Gingo, the crowdfunding platform dedicated to the financing of social projects in Belgium and Luxembourg, was exceeded.

Additional commitments during the Covid-19 crisis:

Donation of 150,000 euros to ’Médecins du Monde’ to support primary care efforts with the most excluded patients;

50,000 euros donated to the 'Fund for solidary care' initiated by the King Baudouin Foundation;

120,000 euros collected by the Gingo platform for the benefit of artists in precarious situations;

Donation of computer equipment to children affected by digital and educational exclusion through the association 'Close the Gap'.

Exceptional financing of three projects by the Degroof Petercam Foundation: 'Revival' which provides support to entrepreneurs facing bankruptcy, 'Microstart' which helps micro-entrepreneurs with loans, as well as a study project on a sustainable and inclusive revival of the economy valuing jobs with a social purpose.

We want society at large to benefit from our work because we have the power to invest consciously.

Activities

| Activities | Belgium | Luxembourg | France | Spain | The Netherlands | Switserland | Germany | Italy |

|---|---|---|---|---|---|---|---|---|

| Private Banking | ||||||||

| Institutional Asset Management | ||||||||

| Investment Banking | ||||||||

| Asset Services |

Belgium

Degroof Petercam (registered office)

Nijverheidsstraat | Rue de l’Industrie 44

1040 Brussel

Antwerp

Vlaams-Brabant

Wemmel

Brabant-Wallon

Brussels

Brussels East

Kempen

Knokke

West-Vlaanderen

Oost-Vlaanderen

Hainaut

Liège

Limburg

Brussels South

Namur

Tournai

Banque Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

2453 Luxembourg

Luxembourg

Degroof Petercam (registered office)

Nijverheidsstraat | Rue de l’Industrie 44

1040 Brussel

Antwerp

Vlaams-Brabant

Wemmel

Brabant-Wallon

Brussels

Brussels East

Kempen

Knokke

West-Vlaanderen

Oost-Vlaanderen

Hainaut

Liège

Limburg

Brussels South

Namur

Tournai

Banque Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

2453 Luxembourg

France

Degroof Petercam (registered office)

Nijverheidsstraat | Rue de l’Industrie 44

1040 Brussel

Antwerp

Vlaams-Brabant

Wemmel

Brabant-Wallon

Brussels

Brussels East

Kempen

Knokke

West-Vlaanderen

Oost-Vlaanderen

Hainaut

Liège

Limburg

Brussels South

Namur

Tournai

Banque Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

2453 Luxembourg

Spain

Degroof Petercam (registered office)

Nijverheidsstraat | Rue de l’Industrie 44

1040 Brussel

Antwerp

Vlaams-Brabant

Wemmel

Brabant-Wallon

Brussels

Brussels East

Kempen

Knokke

West-Vlaanderen

Oost-Vlaanderen

Hainaut

Liège

Limburg

Brussels South

Namur

Tournai

Banque Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

2453 Luxembourg

The Netherlands

Degroof Petercam (registered office)

Nijverheidsstraat | Rue de l’Industrie 44

1040 Brussel

Antwerp

Vlaams-Brabant

Wemmel

Brabant-Wallon

Brussels

Brussels East

Kempen

Knokke

West-Vlaanderen

Oost-Vlaanderen

Hainaut

Liège

Limburg

Brussels South

Namur

Tournai

Banque Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

2453 Luxembourg

Switserland

Degroof Petercam (registered office)

Nijverheidsstraat | Rue de l’Industrie 44

1040 Brussel

Antwerp

Vlaams-Brabant

Wemmel

Brabant-Wallon

Brussels

Brussels East

Kempen

Knokke

West-Vlaanderen

Oost-Vlaanderen

Hainaut

Liège

Limburg

Brussels South

Namur

Tournai

Banque Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

2453 Luxembourg

Germany

Degroof Petercam (registered office)

Nijverheidsstraat | Rue de l’Industrie 44

1040 Brussel

Antwerp

Vlaams-Brabant

Wemmel

Brabant-Wallon

Brussels

Brussels East

Kempen

Knokke

West-Vlaanderen

Oost-Vlaanderen

Hainaut

Liège

Limburg

Brussels South

Namur

Tournai

Banque Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

2453 Luxembourg

Italy

Degroof Petercam (registered office)

Nijverheidsstraat | Rue de l’Industrie 44

1040 Brussel

Antwerp

Vlaams-Brabant

Wemmel

Brabant-Wallon

Brussels

Brussels East

Kempen

Knokke

West-Vlaanderen

Oost-Vlaanderen

Hainaut

Liège

Limburg

Brussels South

Namur

Tournai

Banque Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

2453 Luxembourg

Belgium

Degroof Petercam (registered office)

Nijverheidsstraat | Rue de l’Industrie 44

1040 Brussel

Antwerp

Vlaams-Brabant

Wemmel

Brabant-Wallon

Brussels

Brussels East

Kempen

Knokke

West-Vlaanderen

Oost-Vlaanderen

Hainaut

Liège

Limburg

Brussels South

Namur

Tournai

Luxembourg

Banque Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

2453 Luxembourg

France

Degroof Petercam France

The Netherlands

Switserland

Germany

Italy

Our impact goes beyond generating profit.

Reports