Make a Mark

Annual report 2019

«If I have seen further it is by standing on the shoulders of Giants.»

Sir Isaac Newton marked his time as one of the most influential scientists of all time. For 150 years, we have been leaving our mark on future generations by focusing on a sustainable economy that generates long-term economic and societal value.

Message to the shareholders

A conversation with our president, Ludwig Criel, and our CEO, Bruno Colmant

Since its foundation in 1871, Degroof Petercam has experienced many complex periods. Our strength today is based on that experience, together with the expertise and commitment of all our colleagues.

«We all have dreams. But in order to make dreams come into reality, it takes an awful lot of determination, dedication, self discipline and effort.»

The American athlete Jesse Owens marked his era with his sporting exploits. We go the extra mile to serve our clients with dedication and care, enabling them to realize their ambitions and plans.

Key figures

Net income

in million EUR

480.62018: 454.8

Gross operating profit

in million EUR

84.42018: 111.9

Consolidated net profit

in million EUR

20.22018: 56.8

Staff count

in FTE

14222018: 1,412

Capital structure at 31.12.2019

DSDC*

Petercam Invest*

Financial partners

Management and staff

Own shares

Total number of shares: 10,842,209

Breakdown of operating income

Private Banking (including Credits and Private Equity)

Asset Management

Asset Services

Investment Banking

*Family and reference shareholders.

DSDC : families Philippson, Haegelsteen, Schockert and Siaens, CLdN Finance and Cobepa.

Petercam Invest: Peterbroeck and Van Campenhout families.

Total client assets

Total client assets

(in billion EUR)

| 2019 | 2018 | |||

|---|---|---|---|---|

| Gross | Net* | Gross | Net* | |

| Assets under management ** | 60.0 | 60.0 | 50.5 | 50.5 |

| Assets under administration *** | 40.5 | 8.5 | 34.9 | 7.2 |

| Assets under custody **** | 89.3 | 6.2 | 78.1 | 5.5 |

| Total client assets | 74.7 | 63.2 | ||

* Excluding double counting.

** Management and credit services.

*** Administrative services, including fund accounting, fund directing, registration and set up new funds, transfer agent, etc.

**** Custody services, including recording, holding and custody through securities ans cash accounts.

Key figures

Board of directors

Chairman of the board of directors

Ludwig Criel *

Chairman of the executive committee

Bruno Colmant

Directors-members of the executive committee

Nathalie Basyn

Gautier Bataille de Longprey

Benoît Daenen

Gilles Firmin

François Wohrer

Directors

Yvan De Cock*

Miguel del Marmol

Jean-Baptiste Douville de Franssu

Jean-Marie Laurent Josi

Véronique Peterbroeck

Alain Philippson**

Jacques-Martin Philippson

Kathleen (Cassy) Ramsey*

Alain Schockert

Frank van Bellingen

Guido Vanherpe*

*Independant director

**Until 31/12/2019

Key figures

Breakdown by country of staff count

(in FTE)

| 31.12.2019 | 31.12.2018 | |

|---|---|---|

| Belgium* | 887 | 896 |

| Luxembourg | 357 | 345 |

| France | 100 | 90 |

| Spain | 57 | 59 |

| Switzerland | 21 | 22 |

* Including branches in Germany, Italy and the Netherlands.

«Everyone has oceans to fly, if they have the heart to do it. Is it reckless? Maybe. But what do dreams know of boundaries?»

Amelia Earhart marked her time as the first woman to fly solo across the Atlantic. We believe in a sustainable, inclusive society where everyone has a chance to flourish and realize their dreams.

Highlights

Private banking

38.4 billion euros managed for private clients (gross).

Focus on continued improvement of the client documentation process and of the internal control framework.

Enlarged footprint through:

the opening of two new offices in Wemmel and Turnhout and the recruitment of private bankers to support growth;

the organization of major high-level events in the Degroof Petercam communities such as the eighth edition of Degroof Petercam Business Day for entrepreneurs, the Expert Highlights sessions to share views on financial markets and a trans generational event on Impact investing.

Launch of an advisory digital platform, enabling subscribers to adapt the composition and allocation of their fund portfolio on line.

Above-average returns of portfolios (first quartile).

Innovative services that contributed to growth:

Private Equity projects;

100% socially responsible mandates for clients in discretionary management;

Family Office service dedicated to large families with complex assets;

Dedicated solutions for FBO (Family Business Owners), combining Private Banking and Corporate Finance.

Credits

Net increase in the volume of the credit portfolio to 2.2 billion euros.

Continued strong dynamics in credits in Belgium, Luxembourg and France.

Further development of the Lombard credits offering granted to Belgian, Luxembourg and French clients as an alternative to traditional mortgage loans.

Slight decline in average credit margins despite the competitive credit environment.

Excellent quality of the credit portfolio.

Degroof Petercam Asset Management

39.2 billion euros of assets under management (gross), with a net capital inflow of 2.1 billion euros.

Management of nearly 300 institutional mandates, including a new major mandate granted in France.

Ongoing international expansion, with almost 70% of net new cash stemming from outside Belgium.

Significant inflows in different European strategies and global equities, bonds (global unconstrained, high yield and emerging market debt in local currency) and sustainable strategies across different asset classes and themes.

Launch of a new aggregate bond strategy that focuses on sustainability in terms of climate trends.

Buy-side research team of equity and credit analysts drawing up a recommendation list for more than 100 European and US equities and covering more than 500 high yield and investment grade corporate bonds.

Numerous awards for quality of the management and investment performances:

L’Echo/De Tijd in Belgium: Super Award for the best equity and bond manager over five years;

Scope Awards in Germany: best asset manager bond fund;

SRI Awards in Italy: best SRI assets management firm;

ALFI in Luxembourg: European Distribution Award in the category Fastest Riser in ESG.

Asset Services

40.5 billion euros assets under administration and/or custody (gross).

Set-up of around 40 new funds under Luxembourg or Belgian law.

Operational onboarding of Belgian funds managed and distributed by Degroof Petercam Asset Management (8.5 billion euros) which where migrated on January 2, 2020.

Cross-border migration of an additional sub-fund onto the proprietary custody platform (203 million euros).

Launch of five private equity funds with total commitments of 306 million euros.

Investment Banking

90 mandates in mergers & acquisitions (M&A), capital markets transactions and advisory, confirming Degroof Petercam’s leading position in investment banking services, especially for mid-size companies.

38 M&A mandates totaling 2.3 billion euros of which 13 in Belgium, 23 in France and 2 in Spain.

Landmark debt market capital transactions in Belgium and in France such as the bond issues of Gimv, Leasinvest and Befimmo, the debt financing of Biogroup, the private debt placement for Elis and Vilmorin and acquisition financing for French companies such as Legris, Apax and Axeréal.

6 equity capital market transactions, such as the capital increases of Aedifica, Montéa and TINC.

Expansion of sell-side research to a broader client base in Spain and the United States.

Launch of a new comprehensive derivatives offering and development of a new client base, including first structuring transactions with new institutional clients.

Institutional seminars on healthcare, consumer and real estate sectors and Benelux roadshows in major international financial centers such as New York, London, Paris, Milan, Zurich, Brussels, Amsterdam, Luxembourg and Madrid.

Double digit growth of stock option plans activities, adding 48 new clients in 2019 amongst which several BEL20 companies.

Substantial increase of the dealing desk business in major asset classes worldwide.

Successful launch of Corporate Finance activities in Luxembourg.

Publication of the annual Benelux Company Handbook, team of sell-side analysts covering more than 130 listed companies in the Benelux and distribution of more than 1000 company updates and 60 detailed reports.

Responsible Investment

58% asset increase into SRI funds, or more than 7.2 billion euros invested in sustainable portfolios.

Launch of a new active investment strategy in government and corporate bonds dedicated to the transition to a low-carbon economy. This strategy includes green bonds, companies responding to climate change issues through their services and products, as well as companies in so-called transition sectors.

Labeling of the full range of 11 sustainable strategies according to the Towards Sustainability criteria, defined by the Belgian financial sector.

Focus on climate and active shareholdership:

Member of the collective engagement initiatives 'Responsible outsourcing of cobalt', 'FAIRR' and 'Climate Action 100+';

Signatory of the Investor Charter 'Investor statement on deforestation and forest fires in the Amazon' via the UN backed Principles of Responsible Investment (PRI);

Implementation of the recommendations from the Taskforce on Climate-related Financial Disclosures (TCFD);

171 letters of commitment with companies on their corporate governance through an active voting policy;

Shareholder responsibility through Voting Advisory Board which participated in 650 general meetings of shareholders and voted on 9,266 resolutions.

Further international recognition:

Third consecutive year of UN-PRI’s highest rating (A+);

Top 10 H&K Responsible Investment Brand Index published by Citywire ranking asset managers genuinely committed to ESG;

ALFI European Distribution Award in the category of the Fastest Riser in ESG.

Private Equity

Overall strong performance and pace of deployment of existing private equity investments in line with expectations.

Record fundraising with 250 million euros of new commitments raised across four new investment opportunities.

New initiatives in view of the development of the Private Equity offering in France.

Successful launch of Green Fund IV, a new fund in the renewable energy sector, aimed at pursuing a strategy similar to previous funds focused on onshore wind farm projects in France.

Completion of major exit transaction with the sale of ASL (aviation services), a participation of 3P Air Freighters.

Significant distributions in certain funds and feeder funds, such as Green Fund 2, CA2 Secondaries (Committed Advisors), CVC Capital Partners 6, Down2Earth, Sofindev IV and 3P Tangible Assets Fund.

Philanthropy

2,970 hours of volunteer work performed by 396 colleagues during the seventh edition of Degroof Petercam Solidarity Days covering projects ranging from first aid trainings, tree planting, sporting with refugees and walking with disabled persons and many more initiatives all over Belgium and Luxemburg.

750,000 euros in micro donations gathered through the crowdfunding platform Gingo, supporting 49 projects in Belgium and Luxembourg.

Launch of the skills based sponsorship program with over 50 colleagues involved by advising charity initiatives or mentoring job seekers, in France and Belgium.

20,904 euros awarded to ’Mobile Schools’, a project delivering education to street children in developing countries, thanks to micro donations from colleagues in France, Belgium and Luxemburg.

Collection of funds by the Degroof Petercam Cycling Team for the Foundation against Cancer.

Organization of a conference at the Belgian embassy in Lisbon on Portugal’s pioneering role in social economy and social innovation in presence of Prof. Filipe Santos, dean of the Catolica University and world leader on this topic.

Active participation to NetMentora (entrepreneurial network) and Fundació Banc Dels Aliments (food bank) in Spain.

Long-term advisory mission for a future philanthropist willing to tackle violence against women and children.

1 million euros grant awarded to ‘DUO for a JOB’ selected as the first winner of the new Degroof Petercam Foundation program. DUO for a JOB matches young job seekers with an immigrant background with senior people to accompany and support them in their job search.

Participation in the annual summit of the European Venture Philanthropy Association (EVPA) in The Hague.

Organization of an inspiring conference on the topic of ’Invisible heroes’ in collaboration with DUO for a JOB, the Lunt Foundation and social entrepreneur Julie de Pimodan, founder of Fluicity, an active citizenship app.

Private banking

38.4 billion euros managed for private clients (gross).

Focus on continued improvement of the client documentation process and of the internal control framework.

Enlarged footprint through:

the opening of two new offices in Wemmel and Turnhout and the recruitment of private bankers to support growth;

the organization of major high-level events in the Degroof Petercam communities such as the eighth edition of Degroof Petercam Business Day for entrepreneurs, the Expert Highlights sessions to share views on financial markets and a trans generational event on Impact investing.

Launch of an advisory digital platform, enabling subscribers to adapt the composition and allocation of their fund portfolio on line.

Above-average returns of portfolios (first quartile).

Innovative services that contributed to growth:

Private Equity projects;

100% socially responsible mandates for clients in discretionary management;

Family Office service dedicated to large families with complex assets;

Dedicated solutions for FBO (Family Business Owners), combining Private Banking and Corporate Finance.

Credits

Net increase in the volume of the credit portfolio to 2.2 billion euros.

Continued strong dynamics in credits in Belgium, Luxembourg and France.

Further development of the Lombard credits offering granted to Belgian, Luxembourg and French clients as an alternative to traditional mortgage loans.

Slight decline in average credit margins despite the competitive credit environment.

Excellent quality of the credit portfolio.

Degroof Petercam Asset Management

39.2 billion euros of assets under management (gross), with a net capital inflow of 2.1 billion euros.

Management of nearly 300 institutional mandates, including a new major mandate granted in France.

Ongoing international expansion, with almost 70% of net new cash stemming from outside Belgium.

Significant inflows in different European strategies and global equities, bonds (global unconstrained, high yield and emerging market debt in local currency) and sustainable strategies across different asset classes and themes.

Launch of a new aggregate bond strategy that focuses on sustainability in terms of climate trends.

Buy-side research team of equity and credit analysts drawing up a recommendation list for more than 100 European and US equities and covering more than 500 high yield and investment grade corporate bonds.

Numerous awards for quality of the management and investment performances:

L’Echo/De Tijd in Belgium: Super Award for the best equity and bond manager over five years;

Scope Awards in Germany: best asset manager bond fund;

SRI Awards in Italy: best SRI assets management firm;

ALFI in Luxembourg: European Distribution Award in the category Fastest Riser in ESG.

Asset Services

40.5 billion euros assets under administration and/or custody (gross).

Set-up of around 40 new funds under Luxembourg or Belgian law.

Operational onboarding of Belgian funds managed and distributed by Degroof Petercam Asset Management (8.5 billion euros) which where migrated on January 2, 2020.

Cross-border migration of an additional sub-fund onto the proprietary custody platform (203 million euros).

Launch of five private equity funds with total commitments of 306 million euros.

Investment Banking

90 mandates in mergers & acquisitions (M&A), capital markets transactions and advisory, confirming Degroof Petercam’s leading position in investment banking services, especially for mid-size companies.

38 M&A mandates totaling 2.3 billion euros of which 13 in Belgium, 23 in France and 2 in Spain.

Landmark debt market capital transactions in Belgium and in France such as the bond issues of Gimv, Leasinvest and Befimmo, the debt financing of Biogroup, the private debt placement for Elis and Vilmorin and acquisition financing for French companies such as Legris, Apax and Axeréal.

6 equity capital market transactions, such as the capital increases of Aedifica, Montéa and TINC.

Expansion of sell-side research to a broader client base in Spain and the United States.

Launch of a new comprehensive derivatives offering and development of a new client base, including first structuring transactions with new institutional clients.

Institutional seminars on healthcare, consumer and real estate sectors and Benelux roadshows in major international financial centers such as New York, London, Paris, Milan, Zurich, Brussels, Amsterdam, Luxembourg and Madrid.

Double digit growth of stock option plans activities, adding 48 new clients in 2019 amongst which several BEL20 companies.

Substantial increase of the dealing desk business in major asset classes worldwide.

Successful launch of Corporate Finance activities in Luxembourg.

Publication of the annual Benelux Company Handbook, team of sell-side analysts covering more than 130 listed companies in the Benelux and distribution of more than 1000 company updates and 60 detailed reports.

Responsible Investment

58% asset increase into SRI funds, or more than 7.2 billion euros invested in sustainable portfolios.

Launch of a new active investment strategy in government and corporate bonds dedicated to the transition to a low-carbon economy. This strategy includes green bonds, companies responding to climate change issues through their services and products, as well as companies in so-called transition sectors.

Labeling of the full range of 11 sustainable strategies according to the Towards Sustainability criteria, defined by the Belgian financial sector.

Focus on climate and active shareholdership:

Member of the collective engagement initiatives 'Responsible outsourcing of cobalt', 'FAIRR' and 'Climate Action 100+';

Signatory of the Investor Charter 'Investor statement on deforestation and forest fires in the Amazon' via the UN backed Principles of Responsible Investment (PRI);

Implementation of the recommendations from the Taskforce on Climate-related Financial Disclosures (TCFD);

171 letters of commitment with companies on their corporate governance through an active voting policy;

Shareholder responsibility through Voting Advisory Board which participated in 650 general meetings of shareholders and voted on 9,266 resolutions.

Further international recognition:

Third consecutive year of UN-PRI’s highest rating (A+);

Top 10 H&K Responsible Investment Brand Index published by Citywire ranking asset managers genuinely committed to ESG;

ALFI European Distribution Award in the category of the Fastest Riser in ESG.

Private Equity

Overall strong performance and pace of deployment of existing private equity investments in line with expectations.

Record fundraising with 250 million euros of new commitments raised across four new investment opportunities.

New initiatives in view of the development of the Private Equity offering in France.

Successful launch of Green Fund IV, a new fund in the renewable energy sector, aimed at pursuing a strategy similar to previous funds focused on onshore wind farm projects in France.

Completion of major exit transaction with the sale of ASL (aviation services), a participation of 3P Air Freighters.

Significant distributions in certain funds and feeder funds, such as Green Fund 2, CA2 Secondaries (Committed Advisors), CVC Capital Partners 6, Down2Earth, Sofindev IV and 3P Tangible Assets Fund.

Philanthropy

2,970 hours of volunteer work performed by 396 colleagues during the seventh edition of Degroof Petercam Solidarity Days covering projects ranging from first aid trainings, tree planting, sporting with refugees and walking with disabled persons and many more initiatives all over Belgium and Luxemburg.

750,000 euros in micro donations gathered through the crowdfunding platform Gingo, supporting 49 projects in Belgium and Luxembourg.

Launch of the skills based sponsorship program with over 50 colleagues involved by advising charity initiatives or mentoring job seekers, in France and Belgium.

20,904 euros awarded to ’Mobile Schools’, a project delivering education to street children in developing countries, thanks to micro donations from colleagues in France, Belgium and Luxemburg.

Collection of funds by the Degroof Petercam Cycling Team for the Foundation against Cancer.

Organization of a conference at the Belgian embassy in Lisbon on Portugal’s pioneering role in social economy and social innovation in presence of Prof. Filipe Santos, dean of the Catolica University and world leader on this topic.

Active participation to NetMentora (entrepreneurial network) and Fundació Banc Dels Aliments (food bank) in Spain.

Long-term advisory mission for a future philanthropist willing to tackle violence against women and children.

1 million euros grant awarded to ‘DUO for a JOB’ selected as the first winner of the new Degroof Petercam Foundation program. DUO for a JOB matches young job seekers with an immigrant background with senior people to accompany and support them in their job search.

Participation in the annual summit of the European Venture Philanthropy Association (EVPA) in The Hague.

Organization of an inspiring conference on the topic of ’Invisible heroes’ in collaboration with DUO for a JOB, the Lunt Foundation and social entrepreneur Julie de Pimodan, founder of Fluicity, an active citizenship app.

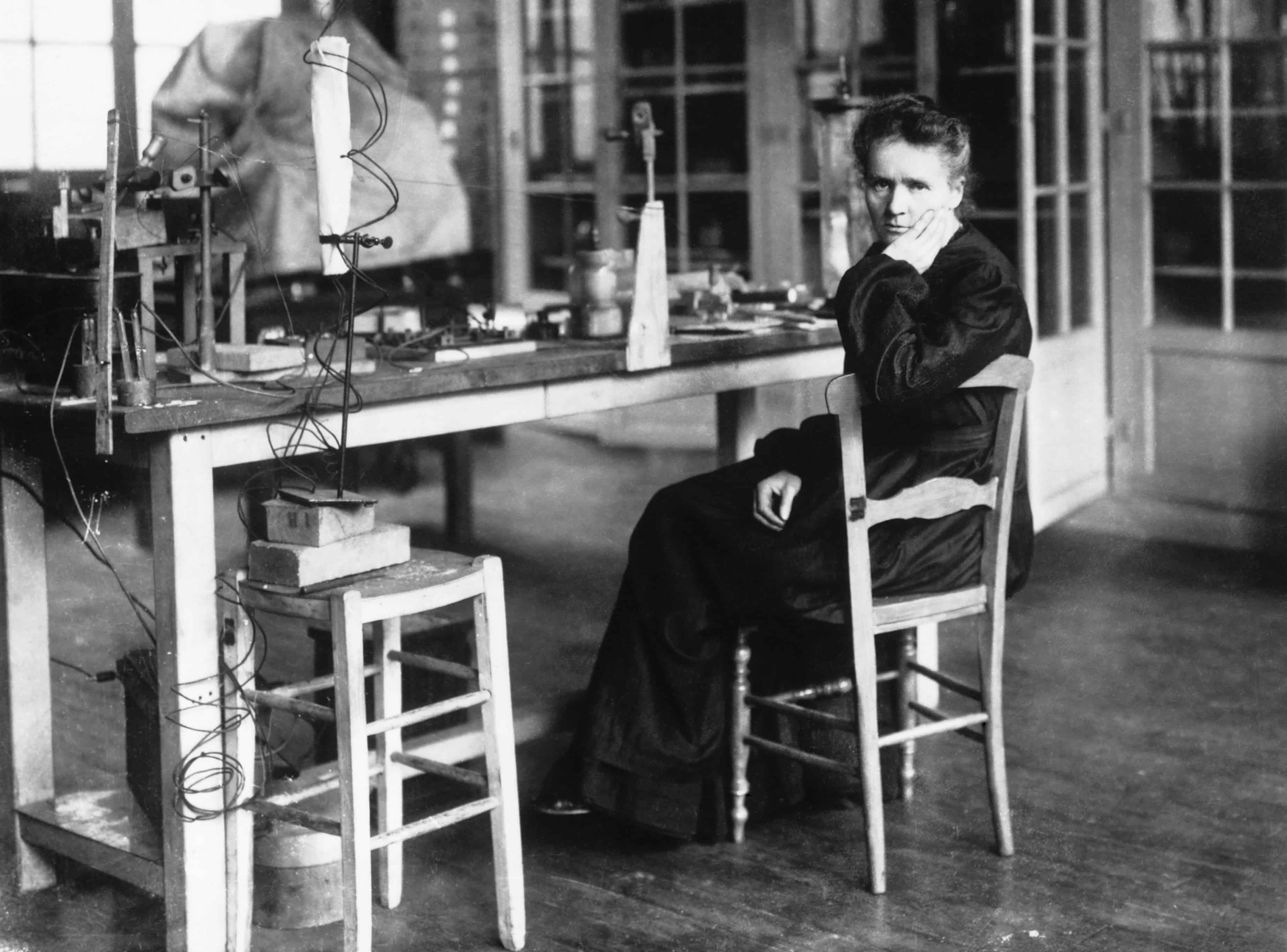

«You cannot hope to build a better world without improving the individuals. To that end, each of us must work for our own improvement.»

The physicist and chemist Marie Curie marked her era withleft her mark on her era with her revolutionary research and scientific discoveries. More than ever, the integration of environmental, social and governance criteria in the management of our activities is an integral part of our sustainable investment strategy.

Activities

| Activities | Belgium | Luxembourg | France | Spain | The Netherlands | Switzerland | Germany | Italy |

|---|---|---|---|---|---|---|---|---|

| Private Banking | ||||||||

| Institutional Asset Management | ||||||||

| Investment Banking | ||||||||

| Asset Services |

Belgium

Degroof Petercam (registered office)

Nijverheidsstraat | Rue de l’Industrie

1040 Brussels

Antwerp

Flemish Brabant

Brabant North-West

Wallon Brabant

Bruxelles

Campine

Coast

West Flanders

East Flanders

Hainaut

Liège

Limbourg

Namur

Tournai

Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Management<br>Sucursal en España

Degroof Petercam Asset Management<br>Zweigniederlassung Deutschland

Degroof Petercam Asset Management<br>Succursale Italiana

Luxembourg

Degroof Petercam (registered office)

Nijverheidsstraat | Rue de l’Industrie

1040 Brussels

Antwerp

Flemish Brabant

Brabant North-West

Wallon Brabant

Bruxelles

Campine

Coast

West Flanders

East Flanders

Hainaut

Liège

Limbourg

Namur

Tournai

Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Management<br>Sucursal en España

Degroof Petercam Asset Management<br>Zweigniederlassung Deutschland

Degroof Petercam Asset Management<br>Succursale Italiana

France

Degroof Petercam (registered office)

Nijverheidsstraat | Rue de l’Industrie

1040 Brussels

Antwerp

Flemish Brabant

Brabant North-West

Wallon Brabant

Bruxelles

Campine

Coast

West Flanders

East Flanders

Hainaut

Liège

Limbourg

Namur

Tournai

Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Management<br>Sucursal en España

Degroof Petercam Asset Management<br>Zweigniederlassung Deutschland

Degroof Petercam Asset Management<br>Succursale Italiana

Spain

Degroof Petercam (registered office)

Nijverheidsstraat | Rue de l’Industrie

1040 Brussels

Antwerp

Flemish Brabant

Brabant North-West

Wallon Brabant

Bruxelles

Campine

Coast

West Flanders

East Flanders

Hainaut

Liège

Limbourg

Namur

Tournai

Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Management<br>Sucursal en España

Degroof Petercam Asset Management<br>Zweigniederlassung Deutschland

Degroof Petercam Asset Management<br>Succursale Italiana

The Netherlands

Degroof Petercam (registered office)

Nijverheidsstraat | Rue de l’Industrie

1040 Brussels

Antwerp

Flemish Brabant

Brabant North-West

Wallon Brabant

Bruxelles

Campine

Coast

West Flanders

East Flanders

Hainaut

Liège

Limbourg

Namur

Tournai

Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Management<br>Sucursal en España

Degroof Petercam Asset Management<br>Zweigniederlassung Deutschland

Degroof Petercam Asset Management<br>Succursale Italiana

Switzerland

Degroof Petercam (registered office)

Nijverheidsstraat | Rue de l’Industrie

1040 Brussels

Antwerp

Flemish Brabant

Brabant North-West

Wallon Brabant

Bruxelles

Campine

Coast

West Flanders

East Flanders

Hainaut

Liège

Limbourg

Namur

Tournai

Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Management<br>Sucursal en España

Degroof Petercam Asset Management<br>Zweigniederlassung Deutschland

Degroof Petercam Asset Management<br>Succursale Italiana

Germany

Degroof Petercam (registered office)

Nijverheidsstraat | Rue de l’Industrie

1040 Brussels

Antwerp

Flemish Brabant

Brabant North-West

Wallon Brabant

Bruxelles

Campine

Coast

West Flanders

East Flanders

Hainaut

Liège

Limbourg

Namur

Tournai

Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Management<br>Sucursal en España

Degroof Petercam Asset Management<br>Zweigniederlassung Deutschland

Degroof Petercam Asset Management<br>Succursale Italiana

Italy

Degroof Petercam (registered office)

Nijverheidsstraat | Rue de l’Industrie

1040 Brussels

Antwerp

Flemish Brabant

Brabant North-West

Wallon Brabant

Bruxelles

Campine

Coast

West Flanders

East Flanders

Hainaut

Liège

Limbourg

Namur

Tournai

Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Management<br>Sucursal en España

Degroof Petercam Asset Management<br>Zweigniederlassung Deutschland

Degroof Petercam Asset Management<br>Succursale Italiana

Belgium

Degroof Petercam (registered office)

Nijverheidsstraat | Rue de l’Industrie

1040 Brussels

Antwerp

Flemish Brabant

Brabant North-West

Wallon Brabant

Bruxelles

Campine

Coast

West Flanders

East Flanders

Hainaut

Liège

Limbourg

Namur

Tournai

Luxembourg

Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

2453 Luxembourg

France

Degroof Petercam France

Spain

Degroof Petercam Asset Management

Sucursal en España

The Netherlands

Switzerland

Germany

Degroof Petercam Asset Management

Zweigniederlassung Deutschland

Italy

Degroof Petercam Asset Management

Succursale Italiana

«With the new day comes new strength and new thoughts.»

As first lady of the United States during her husband's four terms in office, Anna Eleanor Roosevelt marked her era with her accomplishments in the field of human rights. We help investors contribute to a better world and sustainable development through long-term solutions.