Message to the shareholders

“For over 150 years,we have been developing independent, research-based and integrated financial expertise to understand the risks and opportunities in a world in constant motion.”

Read the full message to the shareholders

Buy. Time.

Key figures

Net income

in million EUR

559.0↗

+2.44%

2021: 545.7

Gross operating profit

in million EUR

106.7↘

-15.72%

2021: 126.6

Consolidated net profit

in million EUR

76.4↗

+60.5%

2021: 47.6

Staff count

in FTE

14692021: 1,468

Capital structure at 31.12.2022

DSDC*

Petercam Invest*

Financial partners

Management and staff

Own shares

Total number of shares: 10,842,209

Breakdown of operating income**

Private Banking (including Credits and Private Equity)

Institutional Asset Management

Asset Services

Investment Banking (Corporate Finance and Global Markets)

Total client assets

(in billion EUR)

| 2022 | 2021 | |||

|---|---|---|---|---|

| Gross | Net* | Gross | Net* | |

| Assets under management ** | 59.6 | 59.6 | 69.8 | 69.8 |

| Assets under administration *** | 49.2 | 8.1 | 59.6 | 9.7 |

| Assets under custody **** | 92.6 | 3.4 | 112.3 | 6.5 |

| Total client assets | 71.1 | 86.0 | ||

* Excluding double counting.

** Management and credit services.

*** Administrative services, including investment fund administration, fund accounting, fund domiciliation, registration and set up of new funds, transfer agent.

**** Custody services, including recording, holding and custody through securities and cash accounts.

Breakdown by country of staff count

(in FTE)

| 31.12.2022 | 31.12.2021 | |

|---|---|---|

| Belgium* | 1,002 | 984 |

| Luxembourg | 390 | 372 |

| France | 74 | 87 |

| Switzerland | 3 | 25 |

* Including branches in Germany, Italy, Spain and the Netherlands.

Board of directors

Chairman of the board of directors

Gilles Samyn*

Managing director / Chairman of the management board

Hugo Lasat

Directors / members of the management board

Nathalie Basyn

Sabine Caudron

Filip Depaz

Gilles Firmin

François Wohrer

Directors

Yvan De Cock*

Thomas Demeure

Jean-Baptiste Douville de Franssu

Tamar Joulia-Paris

Jean-Marie Laurent Josi

Jacques-Martin Philippson

Sylvie Rémond*

Kathleen Ramsey*

Frank van Bellingen

*Independent director.

Art. Work.

Highlights

Private banking

35.2 billion euros managed for private clients (gross)

15.2 billion euros in sustainable and responsible investments in Belgium

Relative outperformance of patrimonial funds and portfolios with defensive profiles and mitigated returns for more dynamic profiles

Client service at heart with:

Personalized service from more than 150 private bankers and 75 experts

Further segmentation to offer the right service to the right client

Modernization of our IT infrastructure with the launch of a new core banking system

Further improvement of mobile application My Degroof Petercam through new functionalities

Integration of clients’ sustainability preferences into an appropriate sustainable offering in accordance with MiFID II

Continued consolidation of risk awareness culture through an improved internal control framework

Innovative business development initiatives:

Successful launch of the Small Cap Transaction Advisory desk for advisory services to Family Business Owners

Further development of international hub in Luxembourg for UHNWI (Ultra High Net-Worth Individual) clients in markets such as Portugal, the Netherlands and Canada

Regular mentoring of clients on philanthropic projects

Credits

Total approved credit line portfolio of 2.6 billion euros, an 8% net increase compared to 2021

Expansion of credit offering to Spanish, Dutch and Portuguese clients as an alternative to standard mortgage loans through the subsidiary in Luxembourg

No loss booked and preservation of credit portfolio quality

Energy performance of real estate and climate and environmental risks now integrated into credit policy

Private Equity

Strong performance from private equity funds despite the unfavorable macroeconomic environment and the decline in listed financial markets

Excellent commercial dynamic throughout the entire year with five new private placements

Nearly 200 million euros committed to new feeder funds providing access to various buy-out and secondary strategies, including two new partnerships with renowned international managers specializing in digital transformation and healthcare

Steady rollout of recent funds, with numerous operations related to the life cycle of the funds, such as new deposit requests, as well as distributions for more mature projects

Completion of an innovative Vintage Fund project, aiming to provide access, through a single diversified fund, to most of the private equity funds selected by Degroof Petercam over a one-year period

Investment Banking

More than 70 mandates in mergers & acquisitions, capital markets transactions and advisory, confirming Degroof Petercam’s leading position in investment banking services for mid-size companies

50 M&A and advisory mandates of which 25 in Belgium and 25 in France, for a total of 23.6 billion euros:

35 M&A transactions, including the sale of Dassy to Dovesco, Ellimetal to LRM, Mestdagh group to Les Mousquetaires/Intermarché group, Tobania to Sopra Steria and of Wako to the Oraxys-BGL BNP Paribas consortium, the acquisition of Suez’ water activities by the Veolia consortium and the Meridiam-GIP-CDC/CNP Assurances consortium, the acquisition of Univet by Infravia Environnement and seven acquisitions of laboratories for Biogroup

Several fairness opinions or advisory assignments in the context of takeover bids or mergers (CFE/DEME, Tessenderlo/Picanol in Belgium, Groupe Rousselet (Ada) and Prodware in France)

Significant increase in the number of equity capital market transactions, despite a significant decline in Europe and particularly in the Benelux: 11 transactions, mainly in the healthcare and real estate sectors, and accelerated bookbuildings of new (Avantium, Carmat, Intervest Offices & Warehouses, Oxurion, Sequana Medical) or existing (Xior) shares

10 debt capital market transactions, confirming our number two position in EMEA for private placements according to Dealogic:

Private placements for Ascencio and Cofinimmo and public bond issues for Atenor and Vandemoortele in Belgium

Financing operations for Cristal Union, Keyrus and Pierre & Vacances in France

Strong year for stock options & incentive plans and recruitment of new talent to address staff turnover in the team

Further increase of the derivative services through strengthened cooperation with DPAM, which generated new revenues

Organization of conferences where more than 50 companies met with over 160 investors during about 1,800 meetings

Expansion of share coverage to 220 companies via strategic partnership with IDMidCap

Top five in the Benelux Equity Research category in the Extel Survey Results conducted by Reuters

Increased activity at the trading desk (equities & bonds), especially via our increased visibility abroad

Strengthening of the technical and human resources of the dealing room to cope with the ever more complex environment

First Belgian member of the Sustainable Trading platform, which promotes ESG practices in financial services

Institutional Asset Management (DPAM)

Assets under management (gross) of 42.1 billion euros, a decrease mainly reflecting market effects

2.1% increase in net capital inflows from institutional clients and 3.9% decrease from distribution partners

Confirmation of reference position in Belgium along with continued strong international growth

Launch of two new strategies in emerging markets, leveraging on our existing expertise and joint venture in Hong Kong

Appointment of a new board member responsible for Technology and Data as well as for the implementation of innovative and ambitious pilot projects in collaboration with fintech partners

Attention to succession by the next generation with the appointment of two high potentials as deputy director of the Madrid and Milan branches, which also confirms the continued international development

91% of DPAM funds (gross) in Articles 8 and 9

Joining the Net Zero Asset Managers Initiative (NZAMI) in March 2022 to highlight our commitment to the climate cause

Involved partner of the Belgian Impact Week, with the industry playing a key role in bridging the gap between impact investment and traditional asset management

Participation in 706 shareholder meetings and voting on 10,303 resolutions

Launch of 59 official engagement initiatives, of which 45 defending fundamental values and 14 in the context of controversies

Further implementation of the SFDR-measures (Sustainable Financial Disclosure Regulation) within the European framework for sustainable finance

Asset Services

49.2 billion euros of assets under administration in Luxembourg and Belgian funds (UCITS and AIF), invested in listed and unlisted assets

Rationalization of DPAM’s fund range into two flagship funds: DPAM B (Belgium) and DPAM L (Luxembourg)

Development of new markets with emphasis on Southern European countries, and in particular Spain

16% growth of total commitments in private equity funds under administration to 1.2 billion euros following the launch of three new private equity investment vehicles

Social engagement

Social engagement of coworkers:

160 participants in our microdonation program, raising more than 30,000 euros for three social restaurants (Resto du Coeur in Belgium and France and Stëmm von der Strauss in Luxembourg)

200 participants in our Solidarity Days, where colleagues supported 19 social or environmental initiatives during working hours

10,290 euros raised in favor of the Foundation against Cancer through a biking tour by the Degroof Petercam cycling team

300,000 euros of support spread over a period until 2029 for the project Story-me stimulating entrepreneurial skills in Brussels professional schools

Set-up of an impact investment committee to align the foundation’s private equity investments with its social employment goals

Award of one million euros, supplemented by additional coaching spread over five years, granted to Activ’Action, a French organization that also accompanies Belgian job seekers to learn new skills, to reorient and personally develop themselves during their unemployment period

Publication of the Impact Report of the Degroof Petercam Foundation

75,000 euros support for the Research & Study case Ex’Tax and the inclusive circular economy, on the possibilities and effects of a tax reform in Belgium. It also fits in with the Green Deal, which prescribes investments in new employment needed for a green and sustainable economy

Organization of a client event in the presence of philosopher Charles Pépin and the Foundation's two laureates (Emilie Schmitt of Activ'Action and Matthieu Dardaillon of Ticket for Change), themed ‘Changing the world, utopian or realistic?’

Active promotion of philanthropy in Belgium and Europe through the network of European Venture Philanthropy, Philea, the Belgian Federation of Philanthropic Foundations, European Community of Practice on Impact Management and the Grantmakers collective in France

Private banking

35.2 billion euros managed for private clients (gross)

15.2 billion euros in sustainable and responsible investments in Belgium

Relative outperformance of patrimonial funds and portfolios with defensive profiles and mitigated returns for more dynamic profiles

Client service at heart with:

Personalized service from more than 150 private bankers and 75 experts

Further segmentation to offer the right service to the right client

Modernization of our IT infrastructure with the launch of a new core banking system

Further improvement of mobile application My Degroof Petercam through new functionalities

Integration of clients’ sustainability preferences into an appropriate sustainable offering in accordance with MiFID II

Continued consolidation of risk awareness culture through an improved internal control framework

Innovative business development initiatives:

Successful launch of the Small Cap Transaction Advisory desk for advisory services to Family Business Owners

Further development of international hub in Luxembourg for UHNWI (Ultra High Net-Worth Individual) clients in markets such as Portugal, the Netherlands and Canada

Regular mentoring of clients on philanthropic projects

Credits

Total approved credit line portfolio of 2.6 billion euros, an 8% net increase compared to 2021

Expansion of credit offering to Spanish, Dutch and Portuguese clients as an alternative to standard mortgage loans through the subsidiary in Luxembourg

No loss booked and preservation of credit portfolio quality

Energy performance of real estate and climate and environmental risks now integrated into credit policy

Private Equity

Strong performance from private equity funds despite the unfavorable macroeconomic environment and the decline in listed financial markets

Excellent commercial dynamic throughout the entire year with five new private placements

Nearly 200 million euros committed to new feeder funds providing access to various buy-out and secondary strategies, including two new partnerships with renowned international managers specializing in digital transformation and healthcare

Steady rollout of recent funds, with numerous operations related to the life cycle of the funds, such as new deposit requests, as well as distributions for more mature projects

Completion of an innovative Vintage Fund project, aiming to provide access, through a single diversified fund, to most of the private equity funds selected by Degroof Petercam over a one-year period

Investment Banking

More than 70 mandates in mergers & acquisitions, capital markets transactions and advisory, confirming Degroof Petercam’s leading position in investment banking services for mid-size companies

50 M&A and advisory mandates of which 25 in Belgium and 25 in France, for a total of 23.6 billion euros:

35 M&A transactions, including the sale of Dassy to Dovesco, Ellimetal to LRM, Mestdagh group to Les Mousquetaires/Intermarché group, Tobania to Sopra Steria and of Wako to the Oraxys-BGL BNP Paribas consortium, the acquisition of Suez’ water activities by the Veolia consortium and the Meridiam-GIP-CDC/CNP Assurances consortium, the acquisition of Univet by Infravia Environnement and seven acquisitions of laboratories for Biogroup

Several fairness opinions or advisory assignments in the context of takeover bids or mergers (CFE/DEME, Tessenderlo/Picanol in Belgium, Groupe Rousselet (Ada) and Prodware in France)

Significant increase in the number of equity capital market transactions, despite a significant decline in Europe and particularly in the Benelux: 11 transactions, mainly in the healthcare and real estate sectors, and accelerated bookbuildings of new (Avantium, Carmat, Intervest Offices & Warehouses, Oxurion, Sequana Medical) or existing (Xior) shares

10 debt capital market transactions, confirming our number two position in EMEA for private placements according to Dealogic:

Private placements for Ascencio and Cofinimmo and public bond issues for Atenor and Vandemoortele in Belgium

Financing operations for Cristal Union, Keyrus and Pierre & Vacances in France

Strong year for stock options & incentive plans and recruitment of new talent to address staff turnover in the team

Further increase of the derivative services through strengthened cooperation with DPAM, which generated new revenues

Organization of conferences where more than 50 companies met with over 160 investors during about 1,800 meetings

Expansion of share coverage to 220 companies via strategic partnership with IDMidCap

Top five in the Benelux Equity Research category in the Extel Survey Results conducted by Reuters

Increased activity at the trading desk (equities & bonds), especially via our increased visibility abroad

Strengthening of the technical and human resources of the dealing room to cope with the ever more complex environment

First Belgian member of the Sustainable Trading platform, which promotes ESG practices in financial services

Institutional Asset Management (DPAM)

Assets under management (gross) of 42.1 billion euros, a decrease mainly reflecting market effects

2.1% increase in net capital inflows from institutional clients and 3.9% decrease from distribution partners

Confirmation of reference position in Belgium along with continued strong international growth

Launch of two new strategies in emerging markets, leveraging on our existing expertise and joint venture in Hong Kong

Appointment of a new board member responsible for Technology and Data as well as for the implementation of innovative and ambitious pilot projects in collaboration with fintech partners

Attention to succession by the next generation with the appointment of two high potentials as deputy director of the Madrid and Milan branches, which also confirms the continued international development

91% of DPAM funds (gross) in Articles 8 and 9

Joining the Net Zero Asset Managers Initiative (NZAMI) in March 2022 to highlight our commitment to the climate cause

Involved partner of the Belgian Impact Week, with the industry playing a key role in bridging the gap between impact investment and traditional asset management

Participation in 706 shareholder meetings and voting on 10,303 resolutions

Launch of 59 official engagement initiatives, of which 45 defending fundamental values and 14 in the context of controversies

Further implementation of the SFDR-measures (Sustainable Financial Disclosure Regulation) within the European framework for sustainable finance

Asset Services

49.2 billion euros of assets under administration in Luxembourg and Belgian funds (UCITS and AIF), invested in listed and unlisted assets

Rationalization of DPAM’s fund range into two flagship funds: DPAM B (Belgium) and DPAM L (Luxembourg)

Development of new markets with emphasis on Southern European countries, and in particular Spain

16% growth of total commitments in private equity funds under administration to 1.2 billion euros following the launch of three new private equity investment vehicles

Social engagement

Social engagement of coworkers:

160 participants in our microdonation program, raising more than 30,000 euros for three social restaurants (Resto du Coeur in Belgium and France and Stëmm von der Strauss in Luxembourg)

200 participants in our Solidarity Days, where colleagues supported 19 social or environmental initiatives during working hours

10,290 euros raised in favor of the Foundation against Cancer through a biking tour by the Degroof Petercam cycling team

300,000 euros of support spread over a period until 2029 for the project Story-me stimulating entrepreneurial skills in Brussels professional schools

Set-up of an impact investment committee to align the foundation’s private equity investments with its social employment goals

Award of one million euros, supplemented by additional coaching spread over five years, granted to Activ’Action, a French organization that also accompanies Belgian job seekers to learn new skills, to reorient and personally develop themselves during their unemployment period

Publication of the Impact Report of the Degroof Petercam Foundation

75,000 euros support for the Research & Study case Ex’Tax and the inclusive circular economy, on the possibilities and effects of a tax reform in Belgium. It also fits in with the Green Deal, which prescribes investments in new employment needed for a green and sustainable economy

Organization of a client event in the presence of philosopher Charles Pépin and the Foundation's two laureates (Emilie Schmitt of Activ'Action and Matthieu Dardaillon of Ticket for Change), themed ‘Changing the world, utopian or realistic?’

Active promotion of philanthropy in Belgium and Europe through the network of European Venture Philanthropy, Philea, the Belgian Federation of Philanthropic Foundations, European Community of Practice on Impact Management and the Grantmakers collective in France

Invest. Climate.

Activities

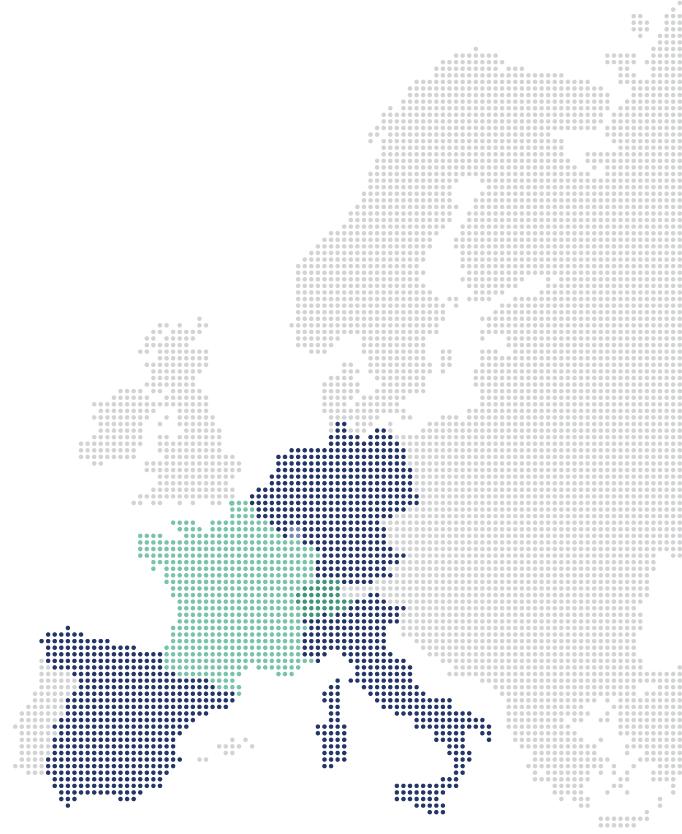

| Activities | Belgium | Luxembourg | France | Spain | The Netherlands | Switzerland | Germany | Italy | Hong Kong | Canada |

|---|---|---|---|---|---|---|---|---|---|---|

| Private Banking | ||||||||||

| Institutional Asset Management | ||||||||||

| Investment Banking | ||||||||||

| Asset Services |

Belgium

Degroof Petercam (registered office)

Nijverheidsstraat 44 | Rue de l'Industrie 44

1040 Brussels

Antwerp

West Flanders

Flemish Brabant

Hainaut

East Flanders

Walloon Brabant

Brussels

Liège

Limburg

Namur

Degroof Petercam Asset Management (DPAM)

Banque Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

L-2453 Luxembourg

DPAM Succursale Luxembourg

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Asset Management SA, Sucursal en España

Degroof Petercam Asset Management Suisse Sarl

Degroof Petercam AM, Zweigniederlassung Deutschland

Degroof Petercam Asset Management SA, Succursale italiana

Spaces San Babila

Syncicap Asset Management, joint venture of OFI AM and DPAM

Bank Degroof Petercam Luxembourg S.A., Canada Representative Office

Unité 300 , 288, Rue Saint-Jacques Ouest

Montréal | H2Y 1N1

Canada

Luxembourg

Degroof Petercam (registered office)

Nijverheidsstraat 44 | Rue de l'Industrie 44

1040 Brussels

Antwerp

West Flanders

Flemish Brabant

Hainaut

East Flanders

Walloon Brabant

Brussels

Liège

Limburg

Namur

Degroof Petercam Asset Management (DPAM)

Banque Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

L-2453 Luxembourg

DPAM Succursale Luxembourg

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Asset Management SA, Sucursal en España

Degroof Petercam Asset Management Suisse Sarl

Degroof Petercam AM, Zweigniederlassung Deutschland

Degroof Petercam Asset Management SA, Succursale italiana

Spaces San Babila

Syncicap Asset Management, joint venture of OFI AM and DPAM

Bank Degroof Petercam Luxembourg S.A., Canada Representative Office

Unité 300 , 288, Rue Saint-Jacques Ouest

Montréal | H2Y 1N1

Canada

France

Degroof Petercam (registered office)

Nijverheidsstraat 44 | Rue de l'Industrie 44

1040 Brussels

Antwerp

West Flanders

Flemish Brabant

Hainaut

East Flanders

Walloon Brabant

Brussels

Liège

Limburg

Namur

Degroof Petercam Asset Management (DPAM)

Banque Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

L-2453 Luxembourg

DPAM Succursale Luxembourg

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Asset Management SA, Sucursal en España

Degroof Petercam Asset Management Suisse Sarl

Degroof Petercam AM, Zweigniederlassung Deutschland

Degroof Petercam Asset Management SA, Succursale italiana

Spaces San Babila

Syncicap Asset Management, joint venture of OFI AM and DPAM

Bank Degroof Petercam Luxembourg S.A., Canada Representative Office

Unité 300 , 288, Rue Saint-Jacques Ouest

Montréal | H2Y 1N1

Canada

Spain

Degroof Petercam (registered office)

Nijverheidsstraat 44 | Rue de l'Industrie 44

1040 Brussels

Antwerp

West Flanders

Flemish Brabant

Hainaut

East Flanders

Walloon Brabant

Brussels

Liège

Limburg

Namur

Degroof Petercam Asset Management (DPAM)

Banque Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

L-2453 Luxembourg

DPAM Succursale Luxembourg

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Asset Management SA, Sucursal en España

Degroof Petercam Asset Management Suisse Sarl

Degroof Petercam AM, Zweigniederlassung Deutschland

Degroof Petercam Asset Management SA, Succursale italiana

Spaces San Babila

Syncicap Asset Management, joint venture of OFI AM and DPAM

Bank Degroof Petercam Luxembourg S.A., Canada Representative Office

Unité 300 , 288, Rue Saint-Jacques Ouest

Montréal | H2Y 1N1

Canada

The Netherlands

Degroof Petercam (registered office)

Nijverheidsstraat 44 | Rue de l'Industrie 44

1040 Brussels

Antwerp

West Flanders

Flemish Brabant

Hainaut

East Flanders

Walloon Brabant

Brussels

Liège

Limburg

Namur

Degroof Petercam Asset Management (DPAM)

Banque Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

L-2453 Luxembourg

DPAM Succursale Luxembourg

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Asset Management SA, Sucursal en España

Degroof Petercam Asset Management Suisse Sarl

Degroof Petercam AM, Zweigniederlassung Deutschland

Degroof Petercam Asset Management SA, Succursale italiana

Spaces San Babila

Syncicap Asset Management, joint venture of OFI AM and DPAM

Bank Degroof Petercam Luxembourg S.A., Canada Representative Office

Unité 300 , 288, Rue Saint-Jacques Ouest

Montréal | H2Y 1N1

Canada

Switzerland

Degroof Petercam (registered office)

Nijverheidsstraat 44 | Rue de l'Industrie 44

1040 Brussels

Antwerp

West Flanders

Flemish Brabant

Hainaut

East Flanders

Walloon Brabant

Brussels

Liège

Limburg

Namur

Degroof Petercam Asset Management (DPAM)

Banque Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

L-2453 Luxembourg

DPAM Succursale Luxembourg

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Asset Management SA, Sucursal en España

Degroof Petercam Asset Management Suisse Sarl

Degroof Petercam AM, Zweigniederlassung Deutschland

Degroof Petercam Asset Management SA, Succursale italiana

Spaces San Babila

Syncicap Asset Management, joint venture of OFI AM and DPAM

Bank Degroof Petercam Luxembourg S.A., Canada Representative Office

Unité 300 , 288, Rue Saint-Jacques Ouest

Montréal | H2Y 1N1

Canada

Germany

Degroof Petercam (registered office)

Nijverheidsstraat 44 | Rue de l'Industrie 44

1040 Brussels

Antwerp

West Flanders

Flemish Brabant

Hainaut

East Flanders

Walloon Brabant

Brussels

Liège

Limburg

Namur

Degroof Petercam Asset Management (DPAM)

Banque Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

L-2453 Luxembourg

DPAM Succursale Luxembourg

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Asset Management SA, Sucursal en España

Degroof Petercam Asset Management Suisse Sarl

Degroof Petercam AM, Zweigniederlassung Deutschland

Degroof Petercam Asset Management SA, Succursale italiana

Spaces San Babila

Syncicap Asset Management, joint venture of OFI AM and DPAM

Bank Degroof Petercam Luxembourg S.A., Canada Representative Office

Unité 300 , 288, Rue Saint-Jacques Ouest

Montréal | H2Y 1N1

Canada

Italy

Degroof Petercam (registered office)

Nijverheidsstraat 44 | Rue de l'Industrie 44

1040 Brussels

Antwerp

West Flanders

Flemish Brabant

Hainaut

East Flanders

Walloon Brabant

Brussels

Liège

Limburg

Namur

Degroof Petercam Asset Management (DPAM)

Banque Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

L-2453 Luxembourg

DPAM Succursale Luxembourg

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Asset Management SA, Sucursal en España

Degroof Petercam Asset Management Suisse Sarl

Degroof Petercam AM, Zweigniederlassung Deutschland

Degroof Petercam Asset Management SA, Succursale italiana

Spaces San Babila

Syncicap Asset Management, joint venture of OFI AM and DPAM

Bank Degroof Petercam Luxembourg S.A., Canada Representative Office

Unité 300 , 288, Rue Saint-Jacques Ouest

Montréal | H2Y 1N1

Canada

Hong Kong

Degroof Petercam (registered office)

Nijverheidsstraat 44 | Rue de l'Industrie 44

1040 Brussels

Antwerp

West Flanders

Flemish Brabant

Hainaut

East Flanders

Walloon Brabant

Brussels

Liège

Limburg

Namur

Degroof Petercam Asset Management (DPAM)

Banque Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

L-2453 Luxembourg

DPAM Succursale Luxembourg

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Asset Management SA, Sucursal en España

Degroof Petercam Asset Management Suisse Sarl

Degroof Petercam AM, Zweigniederlassung Deutschland

Degroof Petercam Asset Management SA, Succursale italiana

Spaces San Babila

Syncicap Asset Management, joint venture of OFI AM and DPAM

Bank Degroof Petercam Luxembourg S.A., Canada Representative Office

Unité 300 , 288, Rue Saint-Jacques Ouest

Montréal | H2Y 1N1

Canada

Canada

Degroof Petercam (registered office)

Nijverheidsstraat 44 | Rue de l'Industrie 44

1040 Brussels

Antwerp

West Flanders

Flemish Brabant

Hainaut

East Flanders

Walloon Brabant

Brussels

Liège

Limburg

Namur

Degroof Petercam Asset Management (DPAM)

Banque Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

L-2453 Luxembourg

DPAM Succursale Luxembourg

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Asset Management SA, Sucursal en España

Degroof Petercam Asset Management Suisse Sarl

Degroof Petercam AM, Zweigniederlassung Deutschland

Degroof Petercam Asset Management SA, Succursale italiana

Spaces San Babila

Syncicap Asset Management, joint venture of OFI AM and DPAM

Bank Degroof Petercam Luxembourg S.A., Canada Representative Office

Unité 300 , 288, Rue Saint-Jacques Ouest

Montréal | H2Y 1N1

Canada

Belgium

Degroof Petercam (registered office)

Nijverheidsstraat 44 | Rue de l'Industrie 44

1040 Brussels

Antwerp

Business center d’Offiz

Degroof Petercam Asset Management (DPAM)

Luxembourg

Banque Degroof Petercam Luxembourg

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Asset Services

Zone d’activité La Cloche d’Or

12, rue Eugène Ruppert

L-2453 Luxembourg

Degroof Petercam Insurance Broker

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

L-2453 Luxembourg

DPAM Succursale Luxembourg

Zone d’activité La Cloche d’Or

14, rue Eugène Ruppert

L-2453 Luxembourg

France

Spain

Degroof Petercam Asset Management SA, Sucursal en España

The Netherlands

Switzerland

Degroof Petercam Asset Management Suisse Sarl

Germany

Degroof Petercam AM, Zweigniederlassung Deutschland

Italy

Degroof Petercam Asset Management SA, Succursale italiana

Spaces San Babila

Hong Kong

Syncicap Asset Management, joint venture of OFI AM and DPAM

Canada

Bank Degroof Petercam Luxembourg S.A., Canada Representative Office

Unité 300 , 288, Rue Saint-Jacques Ouest

Montréal | H2Y 1N1

Canada